I’m going to be writing in detail to you from here, so pay close attention and without any further waste of your time, let’s dive straight into the topic (Proven Ways To Make Money Trading Forex For Beginners | How To Make Money Online | Beginners Guide).

Alright. So we are going to be looking at:

- What is forex trading?

- Why you should trade forex?

- Opening up a trading account with a broker

- Installing the trading platform, and then linking both

- How and when to buy and sell.

What is forex trading?

it’s the exchange of money. Now, I have an example here, so I have 2 currencies. So this one is the Tanzanian shilling and then this is the Kenya shilling. Now you guys know when you go to a forex bureau and let’s say you have the dollar and you want, let’s say, the South African rand in return, you’re going to give away what you have and then get what you have in return. A physical example is if, let’s say, I went with a Tanzanian shilling to the forex bureau and then I needed the Kenyan shilling, I’m going to give this and then get this in return. That’s how easy the concept is.

But this time around, we are entirely doing all the trading online. All you need is your phone or your laptop with Internet, and then you are good to go. We entirely make money in trading by buying and selling. We buy when the price of a currency is going up and then sell when the price of a currency is going down. The forex market is traded by retail traders, big banks, and then hedge funds.

So retail traders are no more traders just like me and most probably you. You are trading with less capital, something that doesn’t sum up lesser to $1,000,000 or something more, then you are a retail trader. Then big banks, most banks actually trade forex. You can actually search up for all the big banks in the world. They do trade forex and then hedge funds.

So we can actually call all these institutional traders. And furthermore, it’s the biggest traded financial markets in the world with a total turnover of about $6,100,000,000,000 per day. Now these numbers are just for us to tap in. Now if you want to learn more about trading and making money online be sure you subscribe if you’re enjoying this article you can also subscribe to our mailing button.

[mailpoet_form id=”1″]

and let’s get back straight into the topic (Proven Ways To Make Money Trading Forex For Beginners | How To Make Money Online | Beginners Guide)

Read Also: Opay Login With Phone Number and Password in Nigeria

Why you should trade forex?

Do easy tasks online to earn straight to your naira account: Start Earning

This is something that I always try to emphasize before getting into any business model, you have to look at the pros and cons.

So here are some of the pros:

PROS:

- TRADE FROM ANYWHERE (GLOBALLY): you can actually trade from anywhere as long as you have your Internet and then your phone. then you can access the global market because it’s global. Each country has a different currency, and all these currencies are always in circulation 247.

- EASY TO START: it’s very easy to start up. Then you can actually trade 24:5. That means you can trade 24 hours in 5 days. So it’s Monday to Friday. The forex market is closed during the weekend.

- YOU GET TO PAY YOURSELF: You get to pay yourself. So you decide in exactly how much you want to make and it’s all up to you.

- FREEDOM (TIME, AND FINANCIALLY): It’s the freedom. So we are looking at time freedom. You decide when to make money. You decide when to trade. The other thing is the financial freedom.

Well, we all trade financial freedom, and it’s all here because you decide exactly how much money you want to make.

Unlock the Secret: How to Earn up to $200+ Daily with Simple Tasks!

Get exclusive access to the platform hundreds of Africans use to make money right from their phone. No experience needed.

Yes, Tell Me More! →CONS:

- EMOTIONALLY TIRING: it’s emotionally tiring. Well, because all the options are on your end, most traders become greedy, revenge trade, and all that so it’s emotionally tiring.

- TRADING IS BORING: So having understood that, let’s go into the process of opening up a trading account.

So for you to trade, you have to have a trading account with a broker. So a broker is basically going to link you, the trader, to the financial markets. So it’s just an intermediate in.

CHOOSING A BROKER

Before choosing a broker, there are a few things that you have to consider.

Do easy tasks to earn staright to your naira account: Start Earning

- Regulations

- Customer Care

- Trading Instruments

- Means of Payments

- Spreads, Commissions & Other Fees

- How Fast are Deposits & Withdraws

I actually did a detailed article about choosing a broker. I’m going to put the link just somewhere up here. For the purpose of this topic, we are going to be using the same broker that I personally use. Now, let’s go straight to it.

Opening up a trading account with a broker

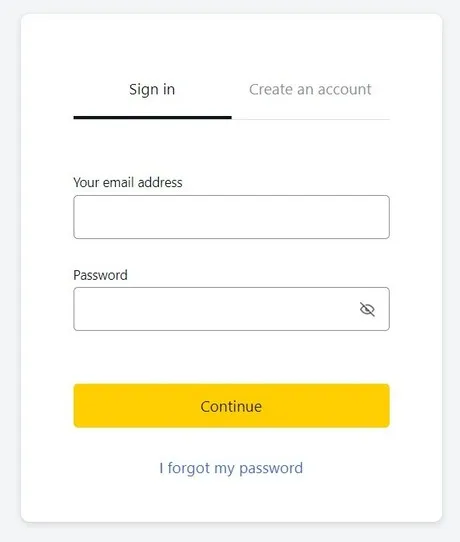

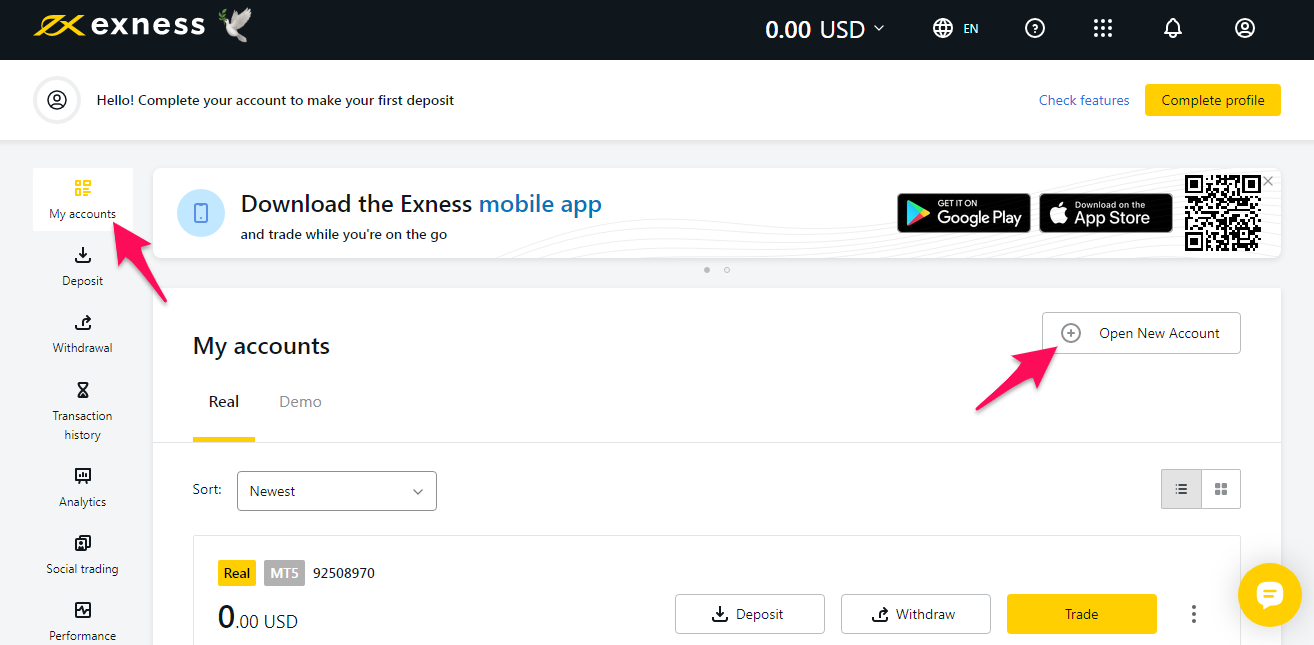

So it’s excellent and now I had opened up the account. It’s very very easy. All you have to do is you are going to fill in your email address and then your phone number and then your name and then after filling in all those, you are going to come to this page. So this is how it looks like. So you have an option of account.

Now for the option of account, you can either decide to start off with a demo account or a real account. So a demo account is just a practice account where you get to do as much practice as possible. Even before you tackle that real chance for you to make real money, it’s recommended that you do as much practice as you can. And then on the other end, your real account is your live account. It’s how you deposit the money and it’s why you withdraw all the money.

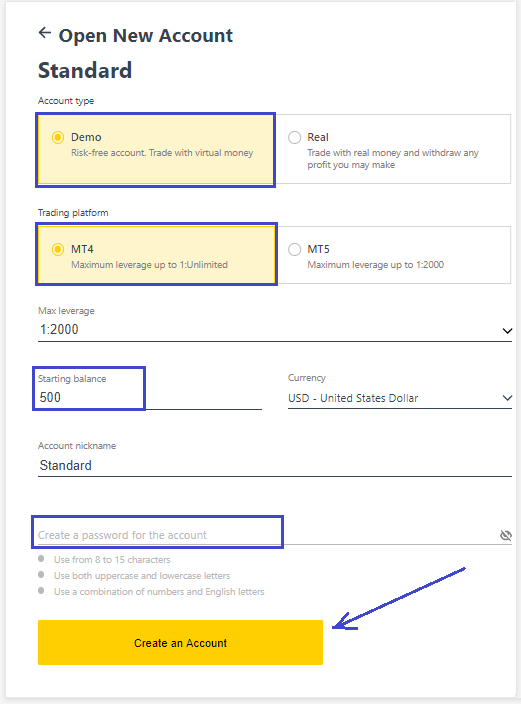

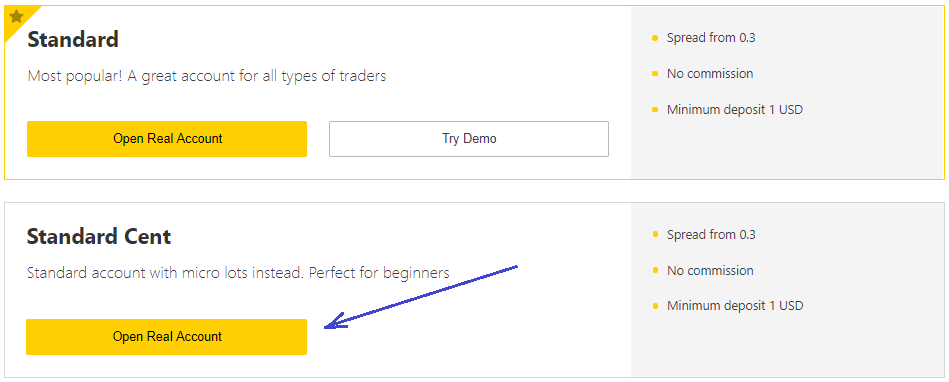

So for the purpose of this article, again, I’m going to create a real account cause I’ve been trading for some time, but you can start off with a demo account first. It’s the same process. So I’m just going to come over here to real account, and then I’ll come and then click on open new account. So there we go. So we have the standard and then we have the standard sent, then we have raw spread and all that, but I’d recommend the standard account.

So I’m going to go ahead and click open real account and then, demo real. I’m going select real and then the platform either m t 4 or m t 5. I’m going to show you this in a minute, but I’m going to choose m t 4. And then the leverage, you can decide to use 1 to 500 maximum. A bigger leverage is a bigger risk.

Now for the currency, it’s the money that you want to be reflected in your trading account. Personally, I would opt for the Uganda shillings because it feels more real. And then it depends on any country. So most people decide to trade with the US dollar, but I would decide to go for the Uganda shillings. There we go.

And then the name, I will say Daniel. And then the password, I can create a password. There we go. So it’s now created. So when I’ve created the account, all I have to do now is to deposit and then I would be able to trade.

So for me to deposit, I going to use my phone and then the local payment options. Now this is mobile money in Uganda, and I think Kenya, there is M Pesa. But you can also opt to use your bank credit card or crypto or any other payment options. Local payment options have limits. You can only deposit up to $800 or some, but if you want to deposit even more, you can decide to use a bank credit card or crypto.

So I’m just going to go ahead and click on deposit. Okay. And then right here, I will choose mobile money for my, for my account. Like, you can see, you can use Kriel. You can use Neteller.

You can use BankCard and other payment options, but I’m going to choose mobile money, and then I’m going to deposit in Ugandan shillings. So a $100 in Ugandan shillings, that’s about 340 or some. That’s how it is. And then click confirm and then click pay. So I’m going to get a notification to my phone that is going to prompt me to enter my password.

See: How to chat with Opay on app and on social media.

Now you can decide to use any other payment options, but, personally, I’d say mobile money very easy because it’s local and very fast. So I’m just going to go ahead and enter my PIN. So for the moment once I refresh the page I will have the deposit made. So it’s $92 I thought it was actually $100.

Installing the trading platform, and then linking both

So once I have the money deposited on, all I have to do again is link x n n to empty phone. So once you have deposited your trading account, now you have to link the broker to that trading platform. So that trading platform, you’re just going to go to app store or Google Play Store, any device that you are using, and then search mt4 or metatrader4. Now, it’s a global platform that is accessed by all traders.

So I personally have the trading platform installed on my phone already. Now once you have installed the trading platform, you are going to come to a section of settings right here and then click on the trade accounts and then click on the plus. Now we are just trying to link this account. So we are just going to come back here and then search, click on this option here, away from trade. We just need the account details.

So click on account information, and there we go. So the server is excellence real twenty. So I’m just going to go ahead and log in because we have the account created already and then search for excellence real 20. So, excellence real 20. I think I typed it wrongly.

Excellence real 20. Okay. There we go. And then the empty for login, it’s 53. Now you can either decide to copy and paste if you are trading on your laptop.

But for my case, I’m just going to copy it manually. And then my password, it’s the one that I used initially. So we should have the account signed in in a minute. Let’s see.

Invalid account. Now the invalid account comes on if you have missed or entered wrong details. But let me just try again real quick. Few moments later. Alright.

How and when to buy and sell.

Now I finally have the account signed in already. So it can show Daniel excellence whatever real. And then the trade balance, it’s 340 what we added on the account account exactly. So at this point now, we are good to trade. So I’m just going to go ahead and show you how I trade.

I’m going to open up a random trade, and I will just show you. So the first option right here is quotes. So quotes are the currency pairs. So, like, from the first example that I showed you, let’s say you’re selling the Uganda shilling for the dollar, it’s 2 currencies. So a quote is going to be a combination of 2 currencies.

We can also call it a currency pair. So just come over here to the plus and add any currency pairs that you would love to trade. So I’m going to go ahead and add USD JPY. I’m actually writing this article very late in the night. So, at this point, I can only trade USD JPY to me as myself.

So, let me go ahead and click trade. Actually, when you click on it and then click on charts, you have this. So this is how the charts look. So I’m going to go ahead and open up a trade. So I’ll come to click trade and then adjust the load size to anything like 0.02 and buy.

So you have options. So it’s either a buy or a sell. So a quick recap, the first step is opening up a trading account with a broker. Again, the link is up here. You can see things that you should consider before choosing a trading broker.

And then after you have opened up an account, you can link the trading account to mt4. For mt4, go to app store or Google Play Store and then type in meta trader 4 or meta trader 5 and then choose 1. And that’s how easy it is. I’m going to be doing more article about how I trade and more detailed articles on how you can actually start trading.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.