Opay is one of the best savings app currently that allows users to save and earn interest.

Reading this post, Fixed, Owealth, Target, Spend & Save: What is Opay Savings?, Interest Rates, FAQs And More, you’ll get to see all the savings plans they offer and how you can start saving to earn interest.

Now if you’re already saving your money and you want to withdraw the interest earned on your savings, then this guide is for you, just read on.

How can I withdraw interest on Opay?

If you’ve saved already using the opay application, you would have noticed that interest is not paid separately, interest you earn on your savings is added to your principal or either calculated and paid out on the payout day you selected while creating your savings plan.

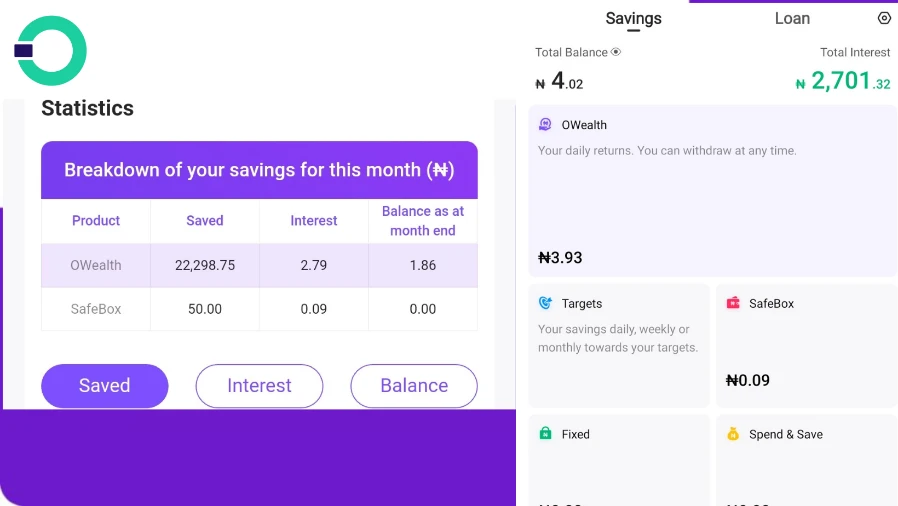

Owealth

Withdrawing interest on owealth

According to Opay:

Your interest is paid into your OWealth account every morning. Deposit funds into OWealth before 23:00 pm and get daily returns the following morning. Note that interest is earned on both the money saved and accumulated interest from previous savings.

opay

this implies that the interest is there in your owealth account, not in a separate balance of its own.

Target

Withdrawing interest on target savings plan

The savings amount and interest will be paid to your OWealth balance at 16:00 pm on the set payback day and no later than 2 days after the payback day. You can use the funds in OWealth to pay bills, make transfers to your OPay balance account or other users’ accounts and withdraw it at any time.

Safebox

Interest on Safebox plan is calculated daily and paid on the first day of the next month.

below formula can be used to calculate your daily interest on Safebox.

Daily interest = Amount * ((1 + Annual Interest Rate) ^ (1/365)-1)*(1-10% withholding tax)

Fixed

Your fixed deposit interest will be paid at the due date along with your principal, you can’t withdraw only the interest in advance and If you withdraw your principal early (liquidation) just note that you’ll lose all of your interest.

So if your savings was to last for 30 days, and you liquidate on the 29th day, all the interest earned will be forfeited.

Spend and save

The annual interest rate of Spend & Save is 15%. In compliance with Nigerian Tax regulations, a Withholding Tax of 10% applies to the interest earned on your savings.

Interest is calculated and paid every day to your spend & save account which can then be Withdrawn at anytime.

Daily interest = Spend & Save balance *((1+ annual interest rate)^(1/365)-1) * (1-10% withholding tax)

Unlike other savings plan like fixed and Safebox, Withdrawals on spend and save are processed immediately.

How can I withdraw total interest on Opay?

There’s currently no facility avaliable on the opay application that allows you to withdraw the total interest on all your savings plan at once, so if that’s what you want, you’ll have to visit each plan one after the other to see interest you’ve earned, and Withdraw the one that you are allowed to.

I have money reflecting in the total interest but I can’t withdraw it.i tried but no way.

Pls OPAY how can I achieve this,pls you should work on this pls,thanks

I’m worried because I need to withdraw the money on my opay interest

Thy should be a way to withdraw total interest on opay because I don’t know why I will be having money reflected on my account total interest why I don’t have money on my total balance “please opay you have to sult this out

I need my money opay:

Because i don’t know why i will be having money in savings report and i can’t withdraw it to my opay balance why please explain to please