Opay, currently the most popular mobile money operator in Nigeria with over 35M + 500k active users and agents, supports basic functionalities like transfer and bills payments, as well as having sophisticated savings products.

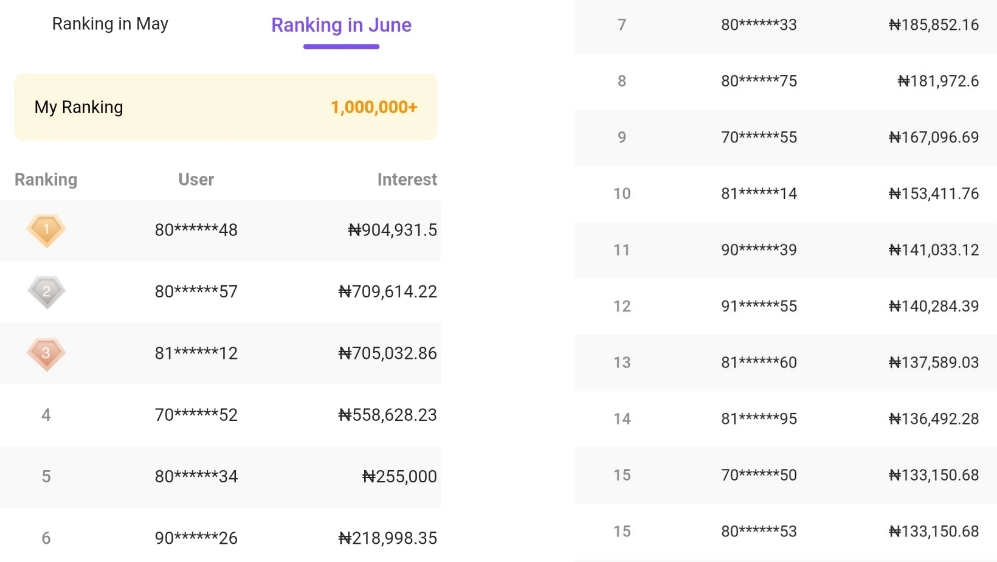

Their saving plans are popular among nigerians and the interest rates are very good. Looking at the screenshot below gotten from their official mobile application, you can see than over a million people are currently saving with opay savings and are earning interests as high as 1 million Naira monthly.

What is opay Savings?

Opay savings is a suite of plans available on the opay mobile application that enables users to save and earn interest on savings while ensuring security, transparency and ease of use.

Opay currently has 5 different savings plan and while they may appear to be much, they’re all unique on their way and offer different varieties to savings.

The plans are:

We’ll start with Owealth, as the most prominent plan and move down till the end, you’ll get to know the different opay savings interest rate for all the savings plan.

Is opay Savings secure & legit?

Opay Savings and its plans are very legit and secure, as OPay is being insured by the National deposit insurance coporation (NDIC) as a verified mobile money operator.

The Nigeria Deposit Insurance Corporation, is an independent agency of the Federal Government of Nigeria. The purpose of the deposit insurance system is to protect depositors and guarantee the settlement of insured funds when a deposit-taking financial institution can no longer repay their deposits, thereby helping to maintain financial system stability.

NDIC

Opay saving plans comparison table

| Intrest | Withdrawal | Penalty | |

| Owealth | 15% | free | null |

| Fixed | 18% | free | null |

| Target | 15% | penalty | 1% of Savings |

| Spend and save | 15% | free | null |

| Safebox | 15% | penalty | 2.5% of withdrawal |

All Opay Saving Plans And Their FAQs

Owealth Savings

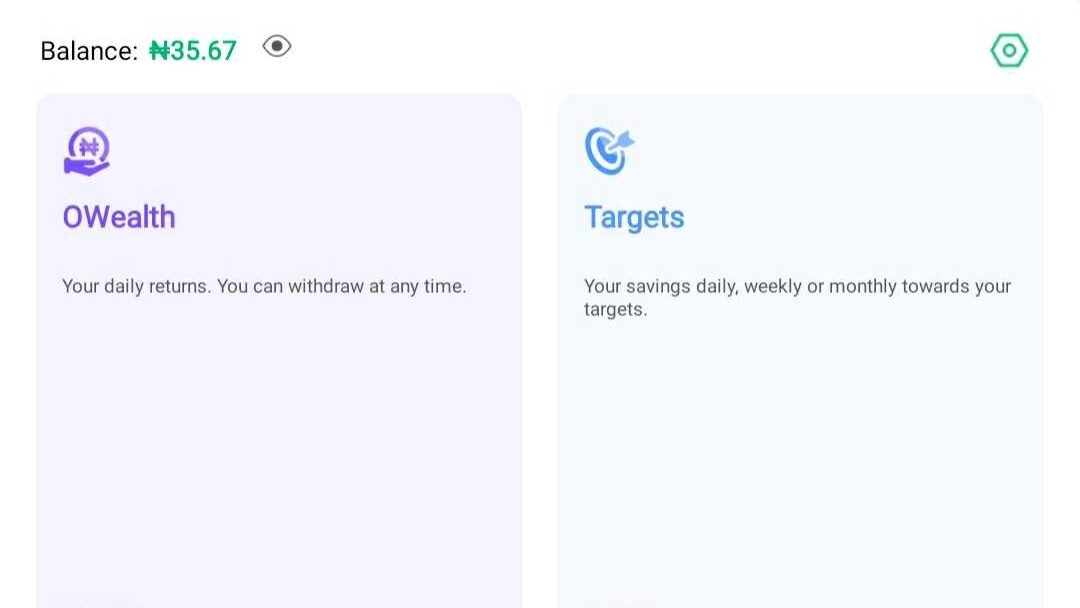

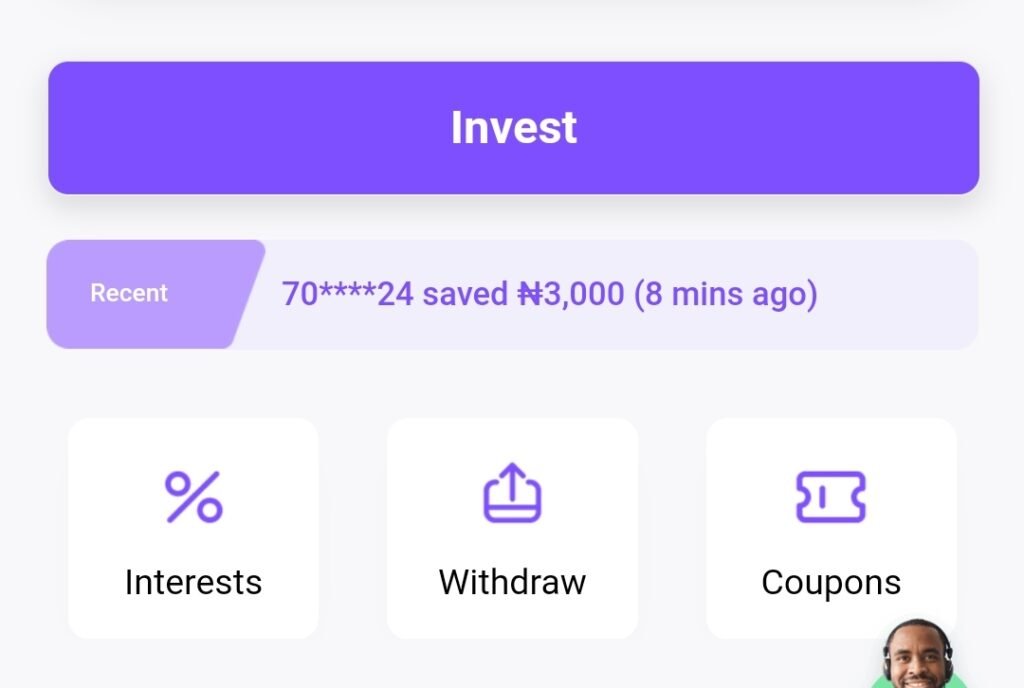

Owealth is the default savings plan on Opay. Here you can save and spend your savings anytime without any restrictions, you also get your interest paid to your account every morning, no matter how big or small you save, you’ll always be paid every morning, so you don’t have to wait till a certain due date to get your interest.

Opay vs Owealth?

The difference between opay and owealth is that opay is the mobile application which you can install on your smartphone and use to carry out several banking operations, while owealth is a savings plan inside the Opay application that enables users to save, spend and withdraw their savings at anytime, flexibly.

How much interest do I earn with Owealth?

With owealth, you get 15% annual interest for savings of N100,000 and below. For savings above N100,000, you’ll get 15% annual interest for the first 100k and 5% interest for the remainder of the savings.

How is Owealth interest paid?

Interest is paid out every morning to your Owealth account, you don’t have to wait till a certain due date, which is great if you want daily interest.

Can i withdraw my Owealth savings anytime?

Yes, you can withdraw the savings on your Owealth plan at any time without any penalty or fee. You can also spend the money on owealth without even withdrawing it to your normal opay account.

Is Owealth legit?

Yes, owealth is legit as it is insured by the National deposit insurance coporation (NDIC), if something ever happens to opay owealth, you’ll be paid your savings upto 500,000 Naira.

How can i deposit on Owealth?

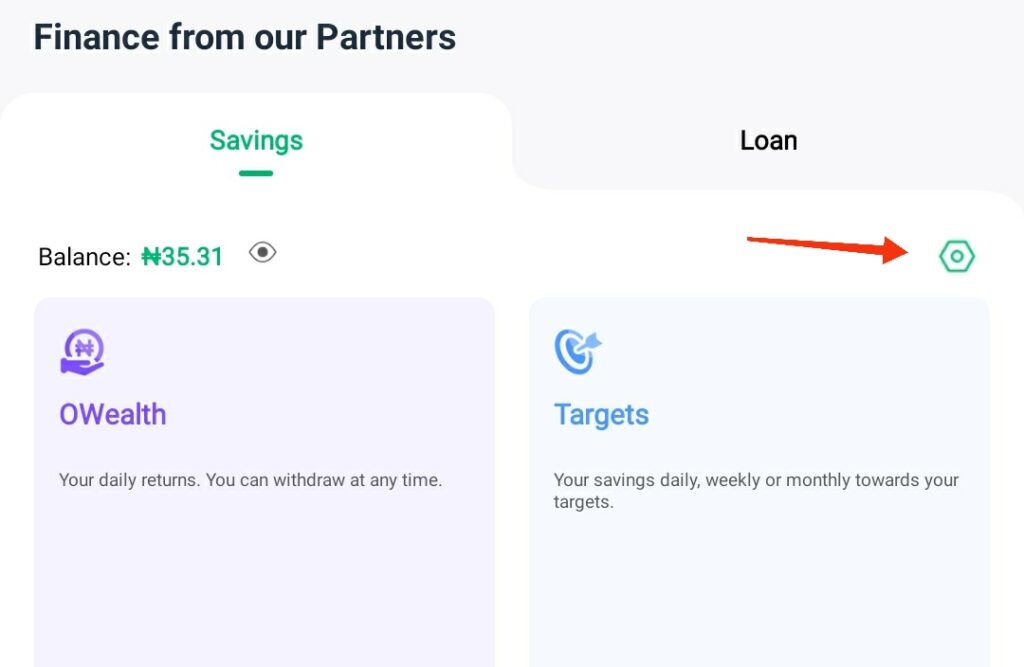

- Open your opay application on either android or iphone

- Check the footer navigation, and click on “finance”

- The savings page will open, check and click on “Owealth”

- Click on “invest”

- Enter the amount you want to invest and “click on confirm”

- You’ll receive a “successful transfer to your Owealth account” message.

- That’s the end.

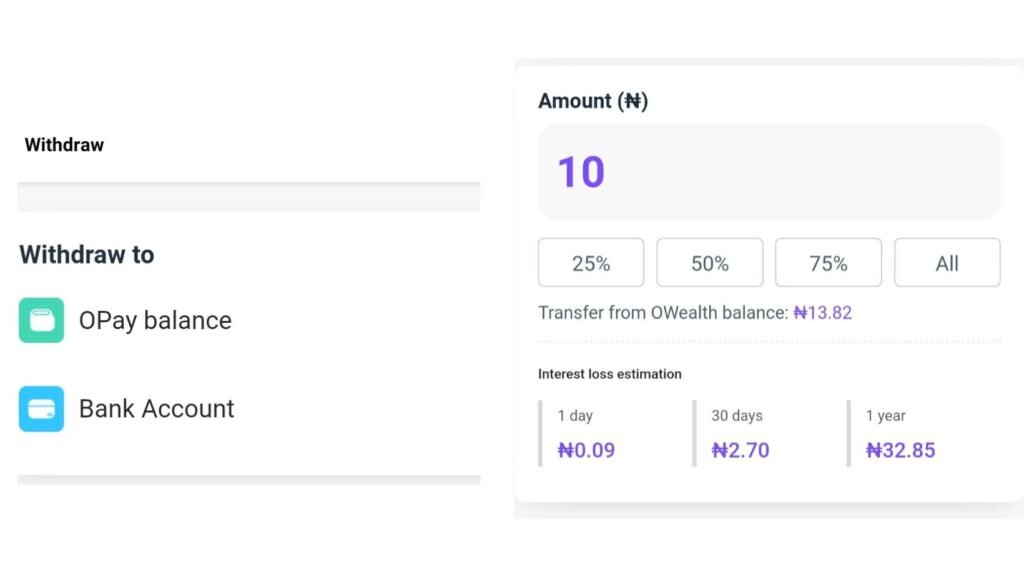

How to withdraw from owealth to opay balance?

To withdraw from owealth to opay:

1. On your Opay app, click on “finance” on the bottom navigation.

2. The savings screen will come up, “click on Owealth”.

3. On the owealth screen click on “withdraw”

4. Select the account you want to withdraw to, either your Opay account or bank withdrawal and input the amount you want to withdraw.

5. If you want to do bank withdrawal, fill in the account details and confirm the transaction, if you want to transfer to opay balance just click confirm.

6. Click confirm again and transfer.

7. Transfer successful. That’s all.

How to activate automatic deposit on owealth?

1. On your Opay app, click on “finance on the bottom navigation”

2. Click on the “gear icon” on the top right of the screen

3. Click on “automatic investment”

4. Click on “settings“

5. Click on “receive money directly to your opay”

6. Click on “apply”

Pros & Cons of owealth

Pros:

- Interest is paid daily

- No fee or penalty on withdrawal

- You can use the savings on owealth while still earning interest

Cons:

- Not a proper savings plan if you’re looking to save for the future

- Too easy to get your savings and lavish it away.

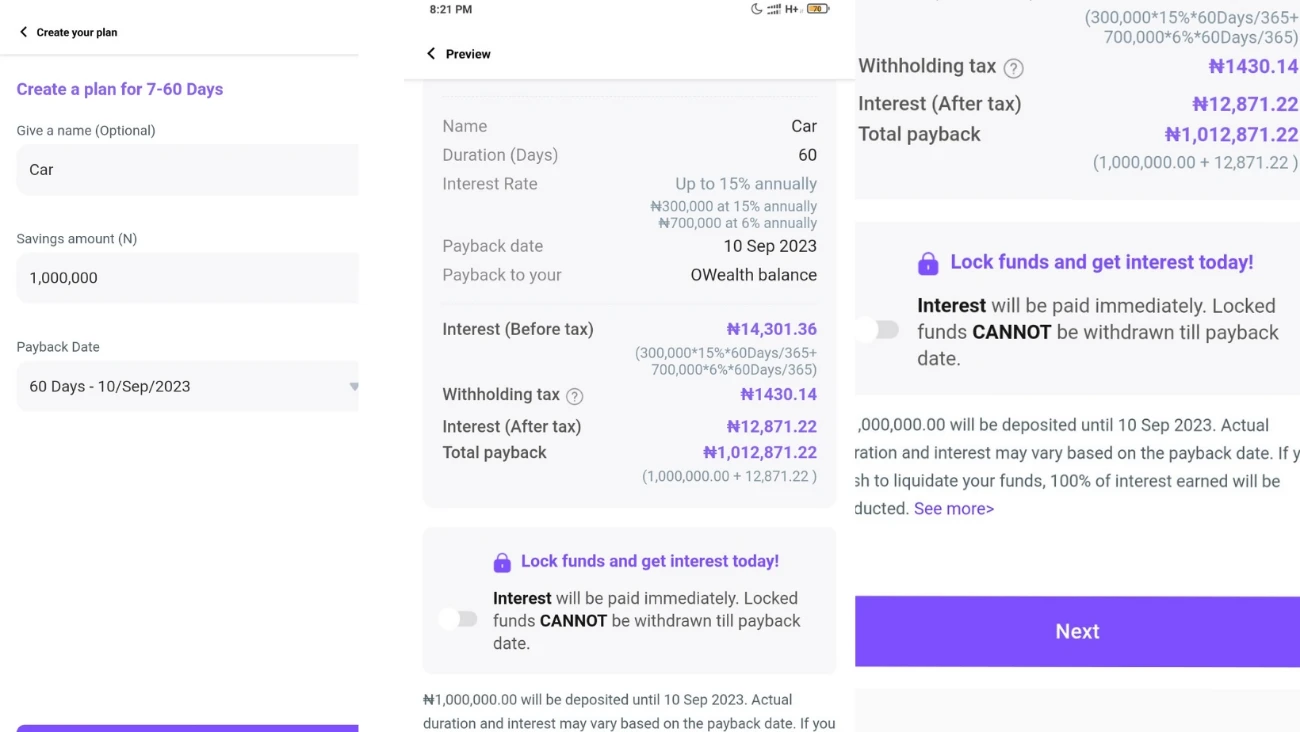

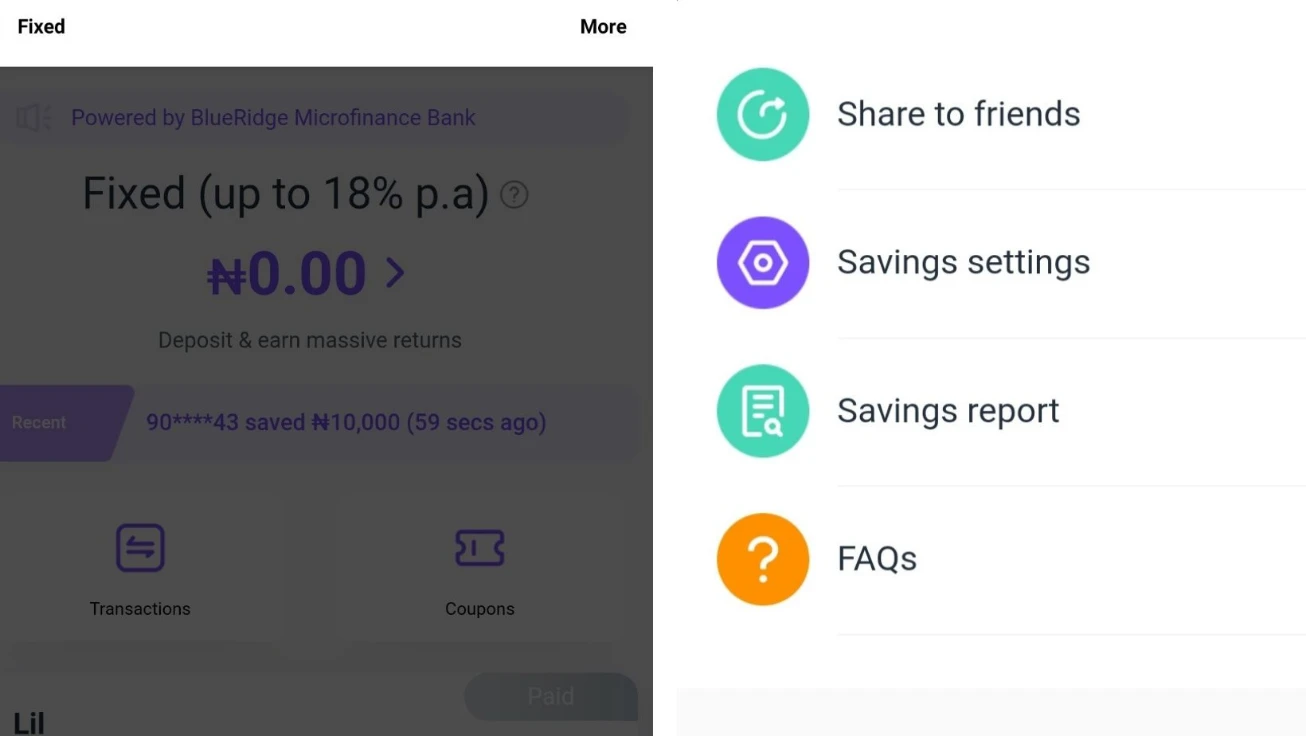

Opay Fixed Savings

Opay fixed savings is a plan that gives you interest on fixed deposit savings, unlike Owealth that interest is paid out daily, fixed savings interest is only paid out on due date along with the principal.

How much interest do I earn with Fixed deposit savings?

For savings of N300,000 and below you’ll be paid 15-18% Annual interest and for savings of N300,000 and above, you’ll be paid interest of 15-18% for the first 300k and 6% interest for the remainder of the money.

Opay Fixed savings intrest table

| Duration (Days) | Balance ≤ N300k | Balance > N300k |

| 7-60 | 15% | 6% |

| 61 – 180 | 16% | 7% |

| 181 -364 | 17% | 8% |

| 365 – 1000 | 18% | 9% |

How does Opay fixed deposit savings works?

Opay Fixed deposit has two modes, locked and unlocked, If you choose to lock your funds when creating your fixed deposit plan, all the interest will be paid to you immediately and your funds will be locked up for the number of days, weeks or months you choose, but if you don’t lock your funds, your interest will be paid at the due date or at anytime you choose to withdraw, If you withdraw early just note that you’ll lose most of your interest.

How can i withdraw the savings on my Opay fixed deposit?

complete guide: How To Withdraw From Opay Fixed Deposit Account (Complete Guide)

Opay fixed deposit has two modes, locked and unlocked, If you choose to lock your savings, you won’t be able to withdraw it in advance, no matter the circumstances, you will have to wait till the due date in other to withdrawn. But if you don’t lock your funds, you can withdraw it at anytime on your opay fixed savings dashboard without any penalty.

How can i deposit on Opay fixed savings plan?

- Open your Opay application on either iphone or android

- On the footer navigation click on “finance”

- The savings page will open, click on “fixed”

- Click on “create a plan”

- Select the duration period, eg 30-60 days, 60-300 days, 300 days to 1000 days.

- Fill in the appropriate details, like amount and also select whether it will be locked or unlocked and click next

- You’ll be shown a payment page, which you can use either your opay account, Owealth, ATM card or bank deposit to make the payment.

- If successful, your plan will be created.

Opay Target Savings

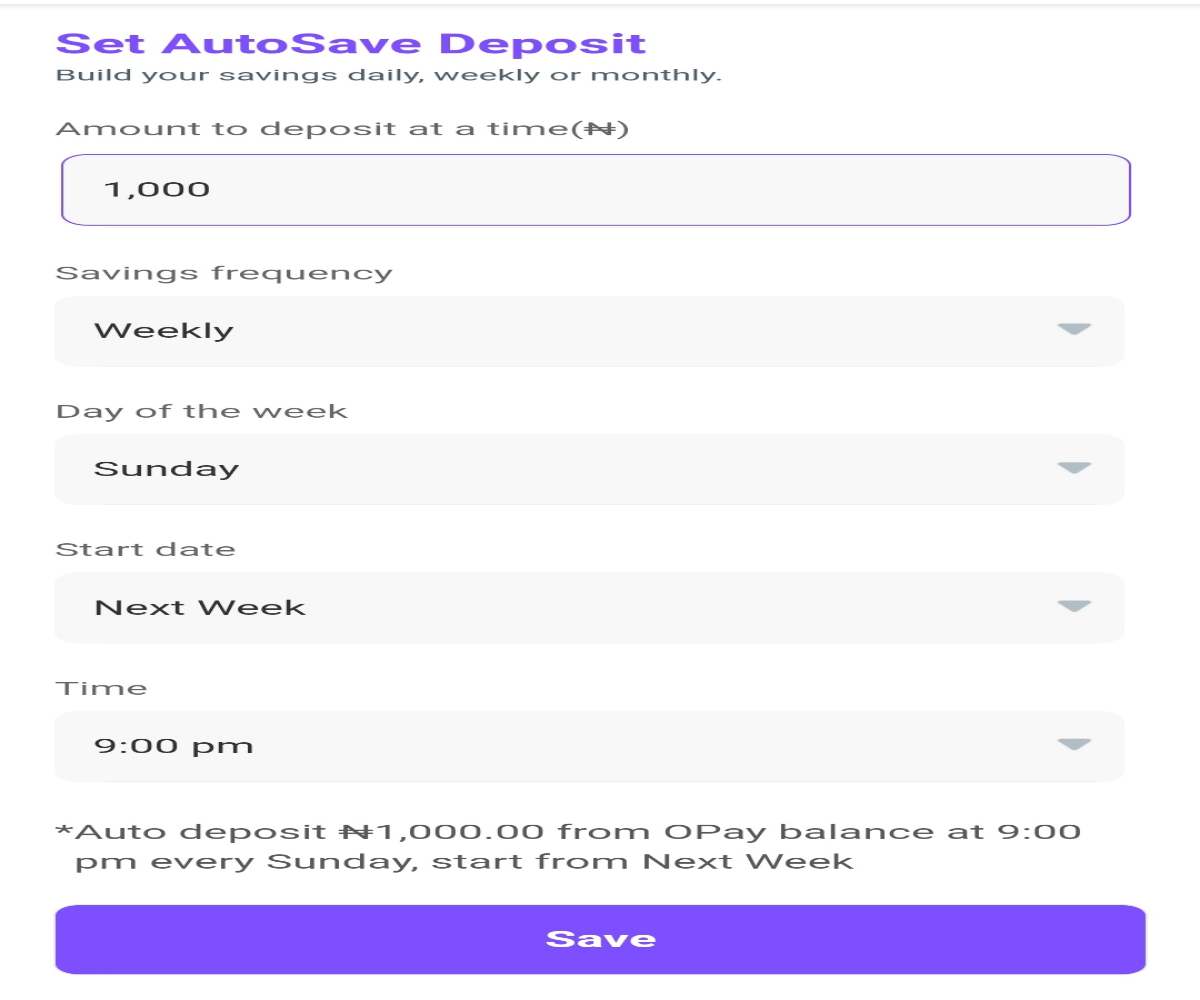

Opay target savings plan allows you to create a daily, weekly or monthly savings plan. With this you’re saving for a specific target, which can be School fee, accomodations, gadget, and so on.

How does Opay Target savings work?

In opay target target savings, you first have to create a plan and set your target, (E.g, saving N50,000 in 100 days), that’ll be your target, You can now choose to either pay daily, weekly or monthly to reach the target, so no matter how much you’re depositing from time to time, at the end, the aim is to reach the target

How much interest do I earn with Target savings?

For savings balance N300,000 and below you’ll be paid 15% Annual interest. For savings N300,000 and above, you’ll be paid interest of 15% for the first 300k and 6% interest for the remainder of the money.

How is Target savings interest paid?

Interest will be paid on the day of maturity along with your savings, but note that if you don’t reach your target, all the interest earned will be seized, this is a motivation for you to try as much as possible to reach your target.

How to create an Opay Target savings plan

- Open your opay wallet application

- On the footer navigation, click on finance

- Click on target savings

- Click on a goal(purpose of saving) and click on proceed

- Enter the name of plan and amount you want to invest

- Fill in all the details accordingly and create the savings plan.

- The money will always be deducted automatically on the date and time you’ve set while creating your savings plan, (E.g, 9pm every sunday)

How Can i withdraw the savings on my OPay Target savings ?

- Open your Opay application and click on finance on the bottom navigation.

- Click on Target and proceed.

- On the target screen, it will show all the target plans you’ve created.

- Click on the one you want to withdraw.

- On the screen that opens, click on “break”.

- Select the reason you want to break and confirm by typing your PIN.

- Your money will be sent your owealth account.

Note: In target savings, if you decide to withdraw in advance, no interest will be paid, and a liquidation fee of 1% on the withdrawal amount will charged, this is to enforce savings discipline.

Will I be paid interest if I don’t reach the Target?

No, If at maturity you didn’t reach your target, no interest will be paid. So you must try as much as possible to reach your target.

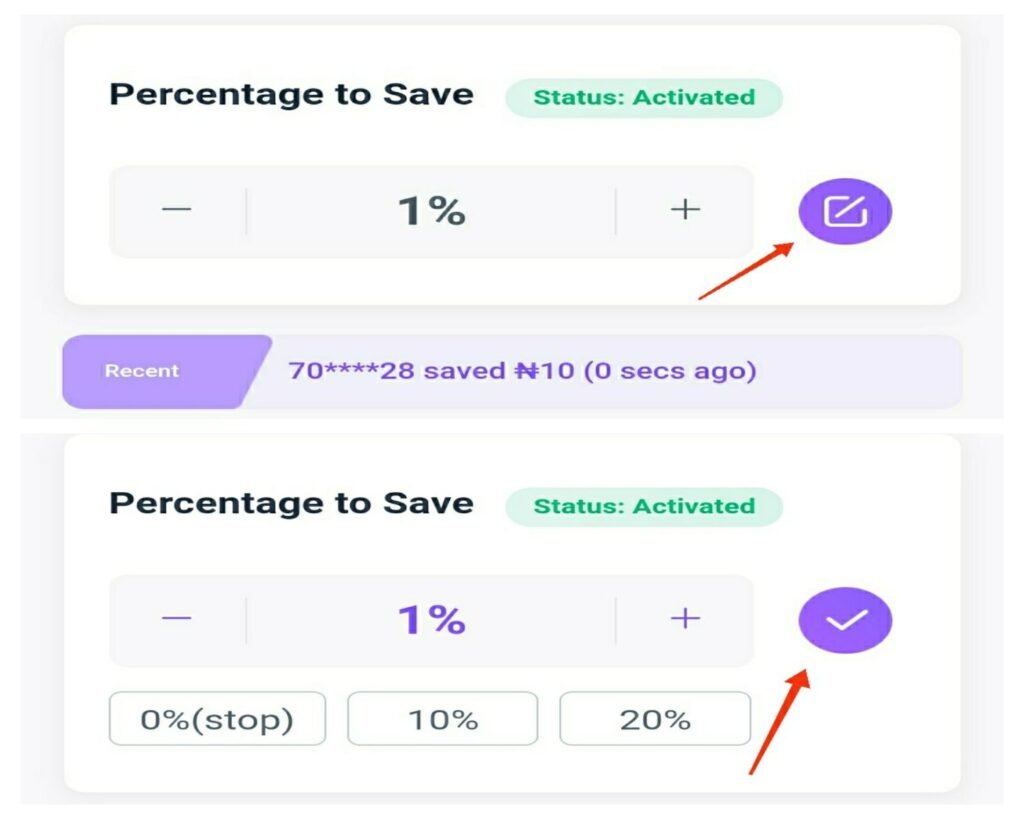

Opay Spend and save

Opay spend and save is a savings plan that encourages users to save a percentage of any amount they spend. Let’s say you set the percentage to 5%, you’ll effectively be saving 5% of any money you spend from your opay account.

How does Opay spend and save work?

It works by you setting a savings percentage and then hitting the “Activate Spend & Save” button. Every time you spend or transfer money on the OPay app, funds are immediately transferred from your OPay Balance to your Spend & Save balance.

Amount automatically transferred = Amount spent * Savings percentage.

Airtime, TV, Electricity, Mobile Data, Betting, Transportation, and Waste Bill Payment are all examples of “Spend” in this sense.

“Transfer” refers to transfers to other bank accounts as well as OPay accounts.

How much interest do I earn with spend and save?

15% interest paid anually, interest is accumulated daily.

How can I cancel spend and save plan?

You can cancel anytime, by setting percentage the percentage on the spend and save screen to 0%.

Can i withdraw the savings on my spend and save anytime?

You can Withdraw spend and save savings anytime, when you cancel it, without any penalty.

How can i activate spend & save on Opay?

- Open your opay application on either android or iphone.

- Check the footer navigation, and click on “finance”

- The savings page will open, check and click on “Spend & Save”.

- Locate and click on “edit icon” beside the “0%”, see the screenshot above.

- Enter the percentage you want to be saving, for every time you spend, example 5%.

- Click the “✔️tick icon” to save.

- That’s the end.

I activated the spend and save in the Opay app, but it’s not saving money while I spend or transfer, What should I do?

If you have activated spend and save but it is not working, then you have to actually wait as this a not a problem from your side, it is a bug from the opay application and it needs to be fixed.

I’ve reached out to opay on twitter concerning this and they’ve promised to fix it, So you have to exercise patience.

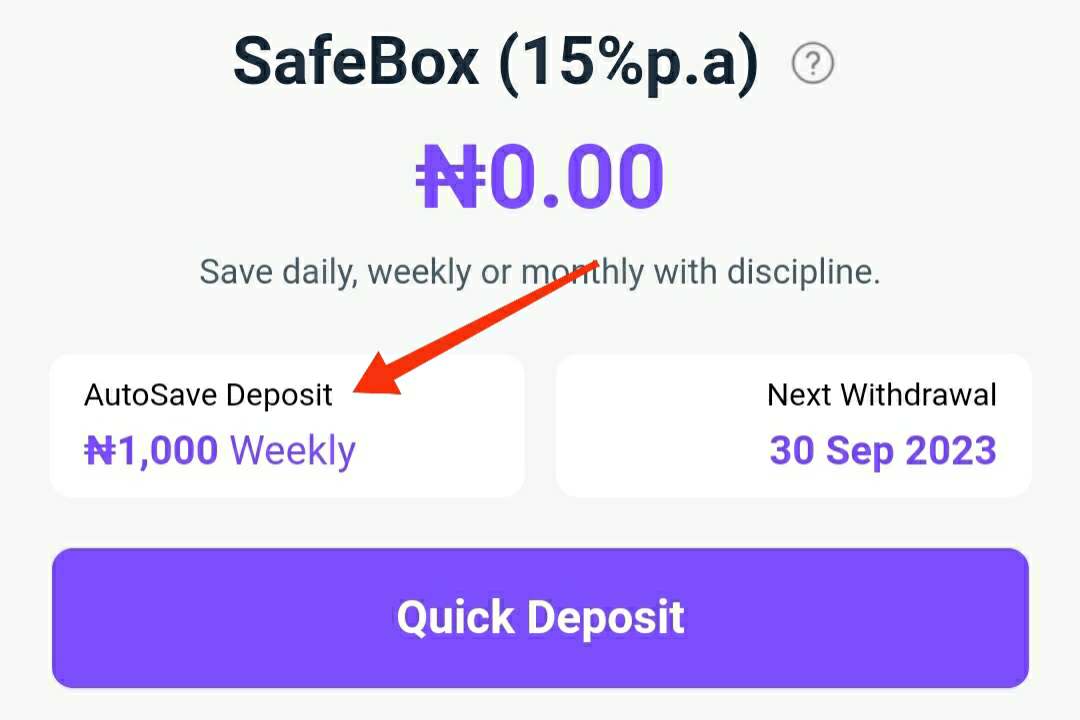

Opay Safebox Savings

Opay Safebox is a savings plan on opay which you can deposit daily, weekly or monthly and earn interest on your savings as you save. The catch here is that to make any withdrawal you’ll have to pay a penalty/breaking fee for withdrawing before the due date. This is to promote savings discipline.

How much interest do i earn with safebox?

For savings balance N300,000 and below you’ll be paid 15% Annual interest. For savings N300,000 and above, you’ll be paid interest of 15% for the first 300k and 6% interest for the remainder of the money.

How is safebox interest paid?

Interest is accumulated daily to your Safebox account, but only paid out to you monthly.

How can i withdraw the savings on my safebox?

You can set the withdrawal date, this is like a maturity date, or you can withdraw on opay default withdrawal dates, which are march 31st, June 30th, September 30th and December 31st.

If you withdraw before the withdrawal date that you set, or apart from any of the four dates above, a breaking fee will be charged. A Breaking fee is a charge deducted for requesting a withdrawal on non-withdrawal days. Breaking fees are 2.5% of the withdrawal amount, This is to promote savings discipline and help you meet your savings goals faster.

How can i deposit on Opay safebox?

- Open your opay application on your smartphone

- Check the footer navigation, and click on “finance”

- The savings page will open, check and click on “Safebox”

- Click on “Turn on auto save deposit”

- Enter the amount you want to invest, select frequency either daily, weekly or monthly, day of the week, starting date and time and “click on save”

- Enter your payment PIN and confirm.

- That’s the end.

How to turn off autosave deposit on opay Safebox?

- On your spend and save screen, click on Autosave deposit.

- Check the bottom of the screen and click on turn off auto save deposit

- Enter payment PIN and confirm.

- That’s all.

How to see all the terms and conditions of each opay saving plan

To see all terms of each opay Saving plan,

- On the opay application, click on finance on the bottom navigation.

- Click any saving plan and click on “more” on the top right

- Click on FAQs

Rounding Up

Opay offers a range of savings plans that cater to the diverse needs of its users in Nigeria. The Owealth plan, with its daily interest payments and easy accessibility, is a popular choice for many.

The Fixed savings plan provides higher interest rates for those looking to lock in their savings for a specific period. The Target savings plan motivates users to reach their savings goals by offering interest payments upon maturity.

The Spend and Save plan encourages users to save a percentage of their spending, while the Safebox plan promotes savings discipline with penalty fees for early withdrawals. With the assurance of being insured by the NDIC, Opay’s savings plans provide secure and legitimate options for everyone looking to grow their savings.

Read also: Cashbox, Fixed: Palmpay Savings Review, Interest Rates, FAQs And More

Read also: FCMB Internet Banking Business Version Login