Palmpay has in recent years become a well known mobile banking operator in nigeria, boasting of over 25 million app downloads as well as 500,000 mobile money agents nationwide.

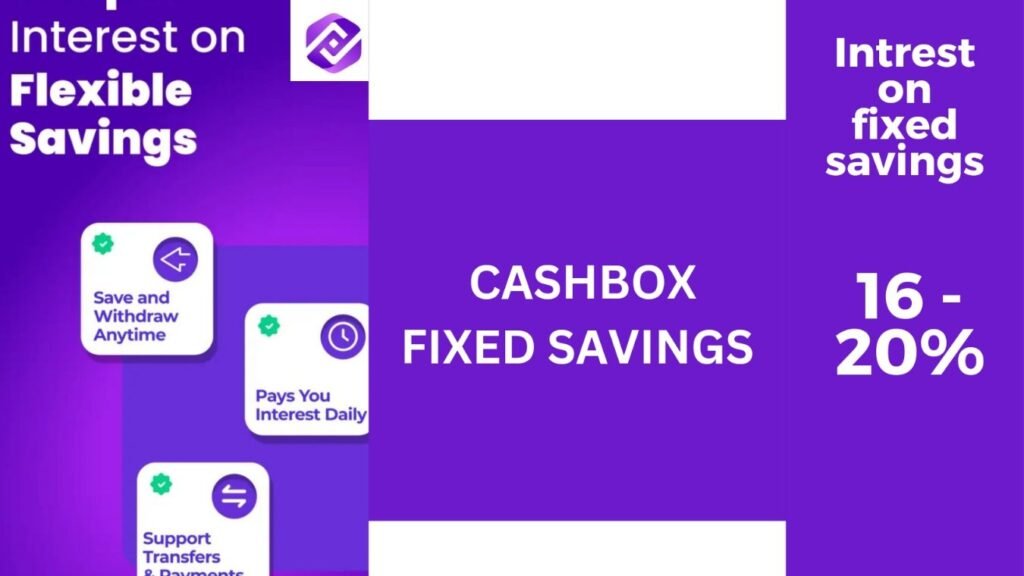

While they’re known mostly for basic banking functions and loan servicing, they also have some saving products that enables users earn intrest on savings.

What is palmpay savings

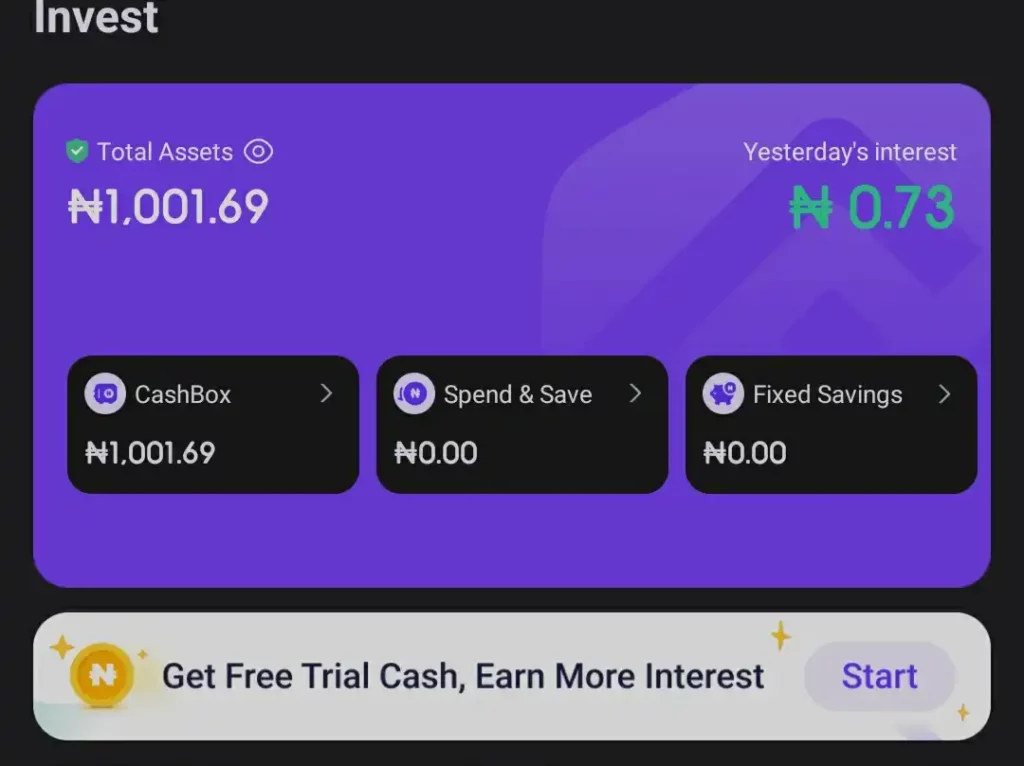

Palmpay savings are suites of savings produts avaliable on the palmpay application on both android and iphone that enables users to save and earn interest on either fixed or flexible savings plans. Palmpay has there distinct savings plans, which are Cashbox, Fixed savings and Spend and Save.

Is palmpay Savings secure & legit?

Palmpay Savings and its plans are very legit and secure, as Palmpay is being insured by the national deposit insurance coporation (NDIC) as a verified mobile money operator.

Saving Plans And Their FAQs

We’ll start with Cashbox, as the most prominent plan and move to Fixed deposit, and finally Spend and Save. You’ll get to know the different palmpay savings interest rate for all the plans.

Palmpay Cashbox Savings Plan

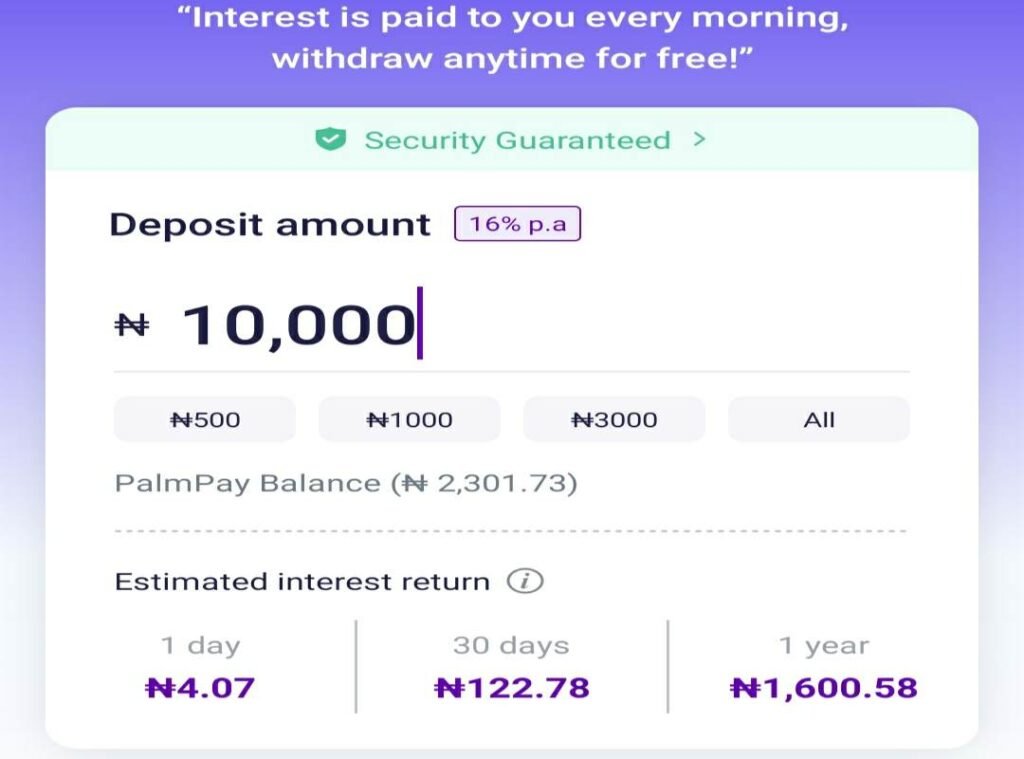

Cashbox is the basic Savings plan on the palmpay mobile application, with cashbox, you can save and spend as you like, you can also withdraw your savings at any point in time without any penalty.

Cashbox Intrest

Cashbox intrest is paid at 16% per annum and is paid daily to your cashbox account, which can be good for compounding, with this you earn daily intrest while your principal amount also keeps growing.

Is Cashbox legit & secure?

Yes, palmpay Cashbox is legit and secure as all deposit and savings on the palmpay application are being insured by the National deposit insurance coporation.

How to deposit on Palmpay cashbox

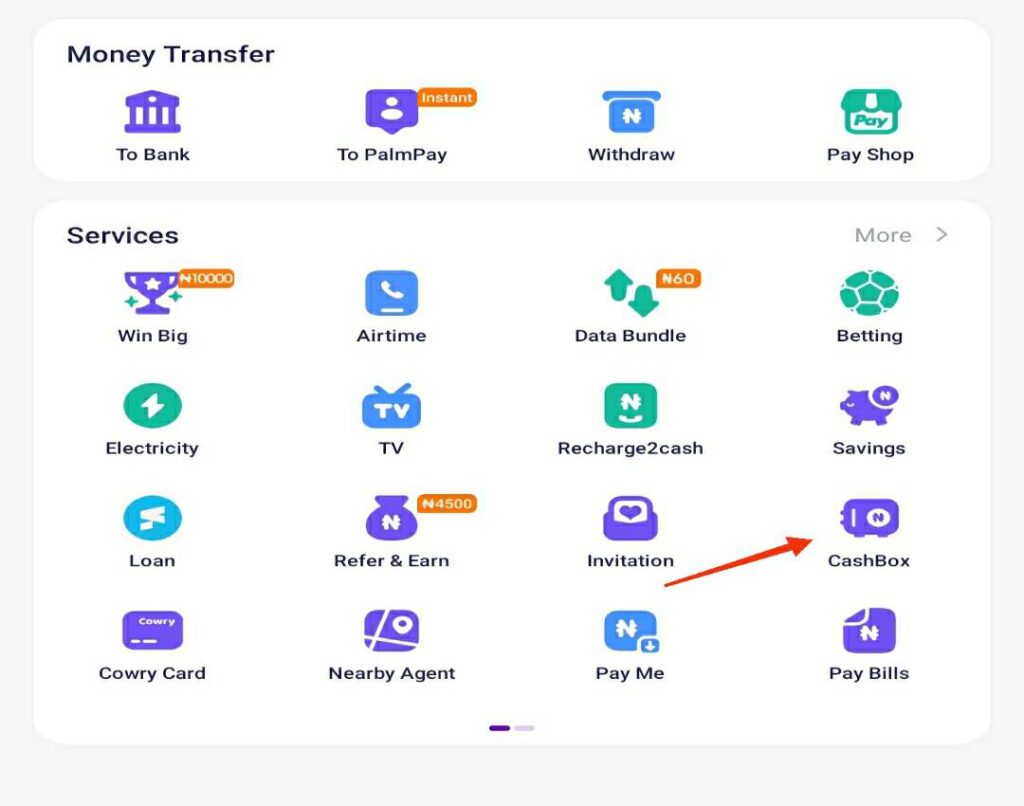

To add money to palmpay cashbox, Follow the following steps.

1. Download the palmpay application on google Playstore or apple Appstore.

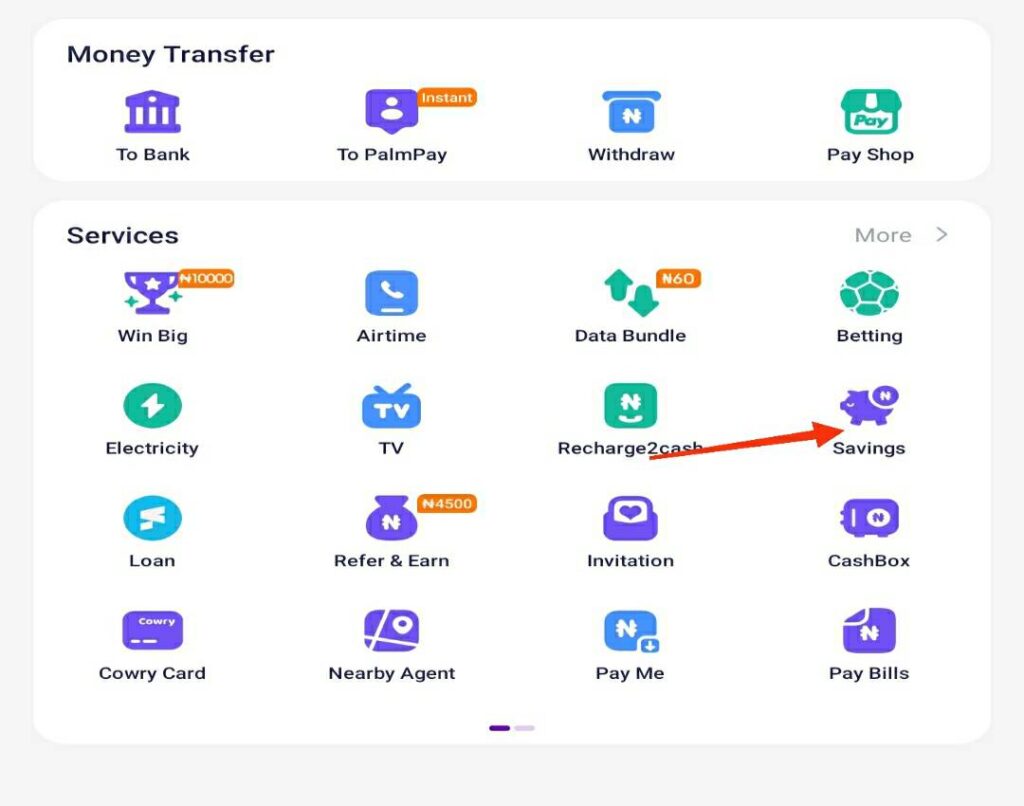

2. Locate and click on the cashbox icon on the palmpay home screen.

3. Click on save now button and it will take you to the savings page, enter the amount of money you want to save and click on “Next”.

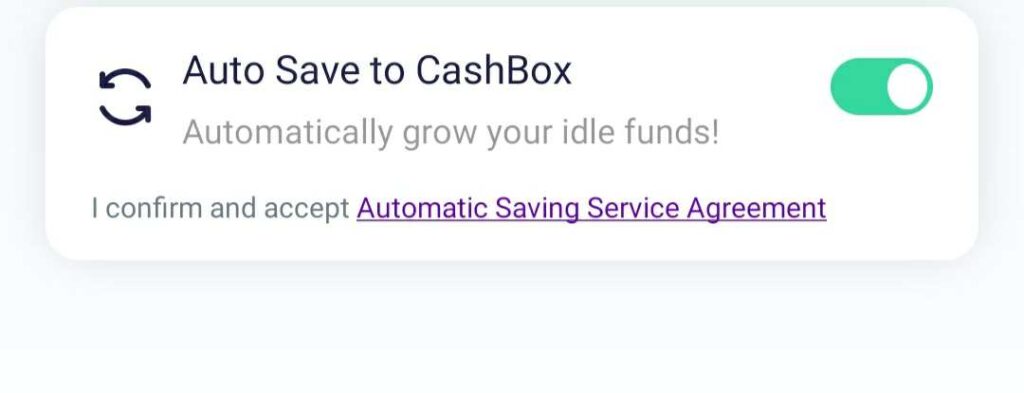

4. Click on the “switch button” if you want to activate automatic Savings too, if you switch on the auto savings button, any money you receive to your palmpay account will automatically be transferred to your cashbox savings account.

5. Click on confirm and it will take you to payment page, click and transfer the money to your cashbox Savings account and your savings journey begins.

See how to withdraw and also turn off Autosave deposit on cashbox

Palmpay Fixed Savings Plan

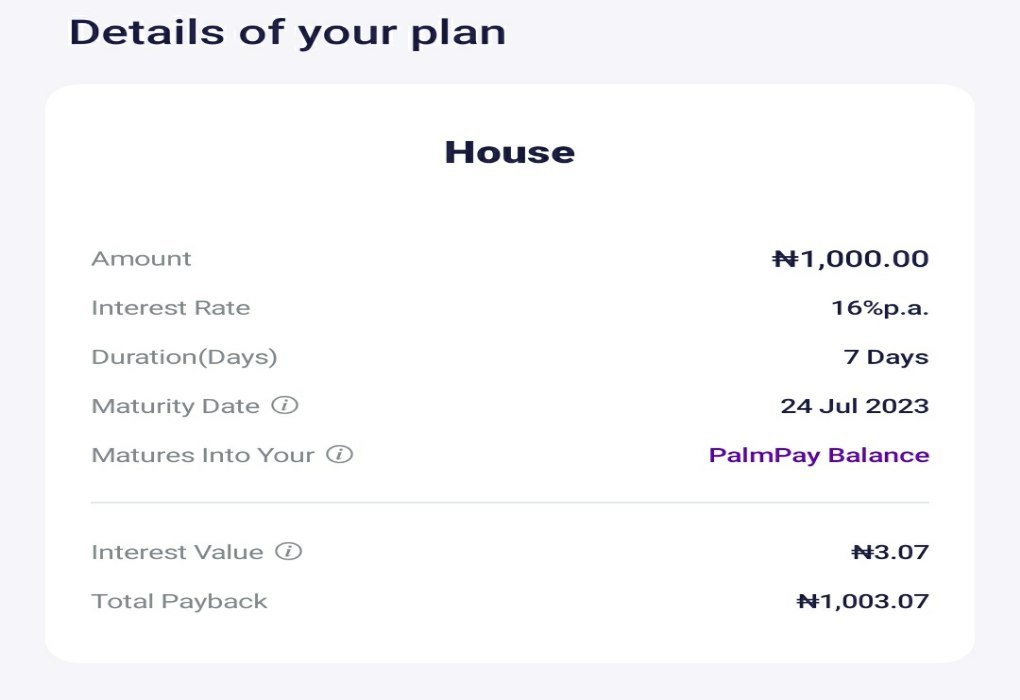

Fixed savings is a savings plan from Palmpay that allows users to earn interest on fixed deposit savings, it has arbitrary interest rates which depends on the number of days you choose to save, the savings is usually locked for the stipulated period and then paid out along with earned intrest on due date.

Savings Intrest distribution table

| Duration (Days) | Interest |

| 7 | 16% |

| 30 | 17% |

| 90 | 18% |

| 180 | 19% |

| 365 | 20% |

How to create fixed deposit savings plan

to create a palmpay fixed deposit plan, follow the steps below.

1. Download the palmpay application on Playstore or App store.

2. Launch the application and Locate savings icon, under services tab.

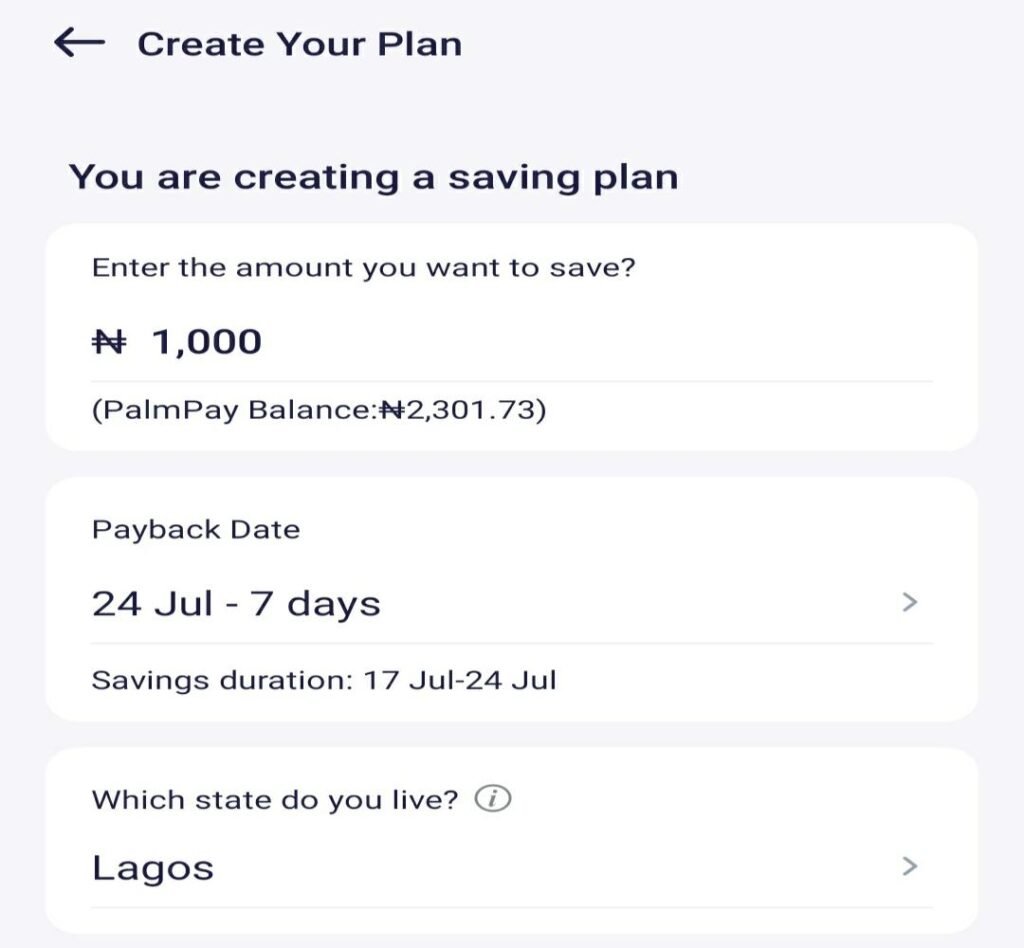

3. On the Savings page, select the number of days You want your savings plan to last.

4. Fill in the appropriate details and confirm.

5. Confirm savings details and accept the terms and conditions of palmpay and confirm

6. Select a payment source and input your transaction PIN and your savings plan will be created.

How can i withdraw the savings on my palmpay fixed deposit?

Once your fixed deposit plan is created, you’ll be able to withdraw the savings anytime you wish on the palmpay fixed savings dashboard. But note that you won’t receive any intrest.

To receive intrest you’ll have to wait till your savings is due and it will be paid out to you, along with the principal.

Palmpay Spend and Save plan

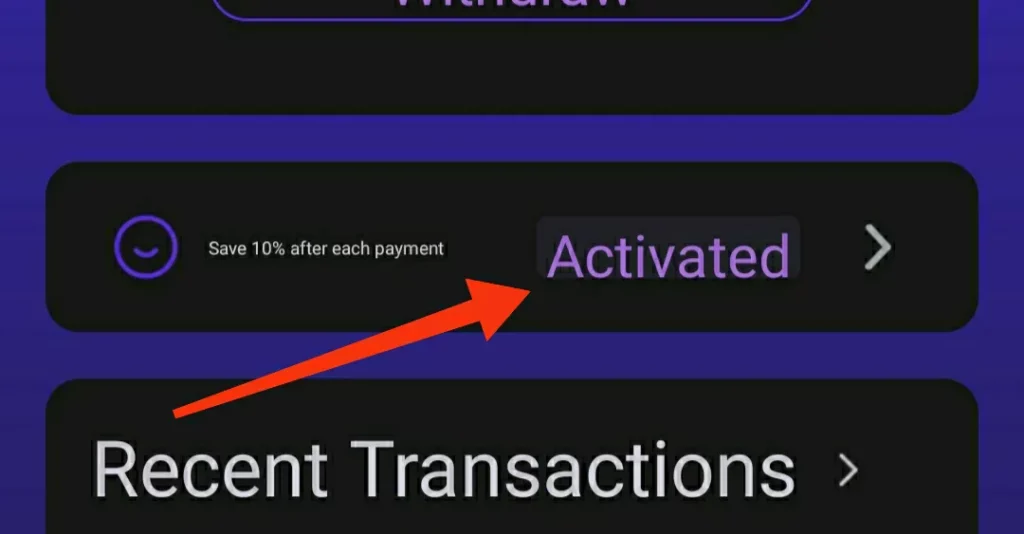

Spend and Save is another savings plan by palmpay that allows users to save a fixed percentage each time they spend.

How this works is that once you activate this plan, anytime you spend on your palmpay application, like buying of airtime, data plans, paying of bills and so on, a percentage of that particular spending will be automatically transferred to your spend and save plan, depending on the percentage you set on the spend and save dashboard.

Example: Let’s say you’ve activated the spend and save plan to save 5% each time you spend.

Now if you buy airtime of N1000, 5% of this amount which is N50 will be credited to your spend and save wallet.

How to activate palmpay spend and save

To activate the Palmpay spend and save plan, please follow the following steps:

1. Open your palmpay application, check the bottom navigation and click on “Invest”.

2. On the page that opens click on “Spend and Save”.

3. Now you’ll either increase or decrease the percentage you’ll be saving each time you spend.

4. Apart from saving in percentage, you can also save a fixed amount of money each time you spend, like N50, N100, N150, N200 and so on.

5. Once you’re done with the above, the next step is to select the “funding source”, this can be either your Palmpay balance or cashbox balance or both.

6. Then check that everything is right, now click on “Start” and put your transaction PIN or fingerprint to activate the plan.

Once you’ve activated it, your plan will start working immediately, you can run a test transaction to see if it’s working.

How to turn off spend and save on Palmpay

Once you plan is active, you can turn it off at anytime you wish to, to do this:

1. On the spend and save dashboard, click on “Activated”.

2. On the top right corner, click on “Turn off”

3. Confirm and put your transaction PIN or fingerprint to turn it off.

Read more: Opay: What is Owealth, fixed and target Savings?, Interest Rates, FAQs And More

Rounding Up

Palmpay Savings offers you convenient and secure options for saving and earning interest. With the Cashbox plan, you have the flexibility to save and spend as you please, while earning an annual interest rate of 16%.

The Fixed savings plan allows you to lock your savings for a specific period and earn varying interest rates based on the duration.

Palmpay’s legitimacy and security are ensured by their insurance coverage from the National Deposit Insurance Corporation. Overall, Palmpay savings provides a reliable platform for individuals in Nigeria to grow their savings efficiently.