Opay fixed savings is a plan available on the opay mobile application that gives users interest on fixed deposit savings, unlike it counterpart Owealth that interest is paid out daily, fixed savings interest is only paid out on due date along with the principal. Read opay savings and Interest rates for full guide.

How does Opay fixed deposit savings works?

Opay Fixed deposit has two modes, locked and unlocked, If you choose to lock your funds when creating your fixed deposit plan, all the interest will be paid to you immediately and your funds will be locked up for the number of days, weeks or months you choose, but if you don’t lock your funds, your interest will be paid at the due date, If you withdraw early just note that you’ll lose all of your interest.

How can i withdraw from Opay fixed deposit?

If you didn’t choose to lock your savings while creating the plan, follow the below guide to withdraw it.

1. Open your Opay application and Navigate to the finance > Savings page

2. Click on “fixed” and proceed to the fixed deposit screen

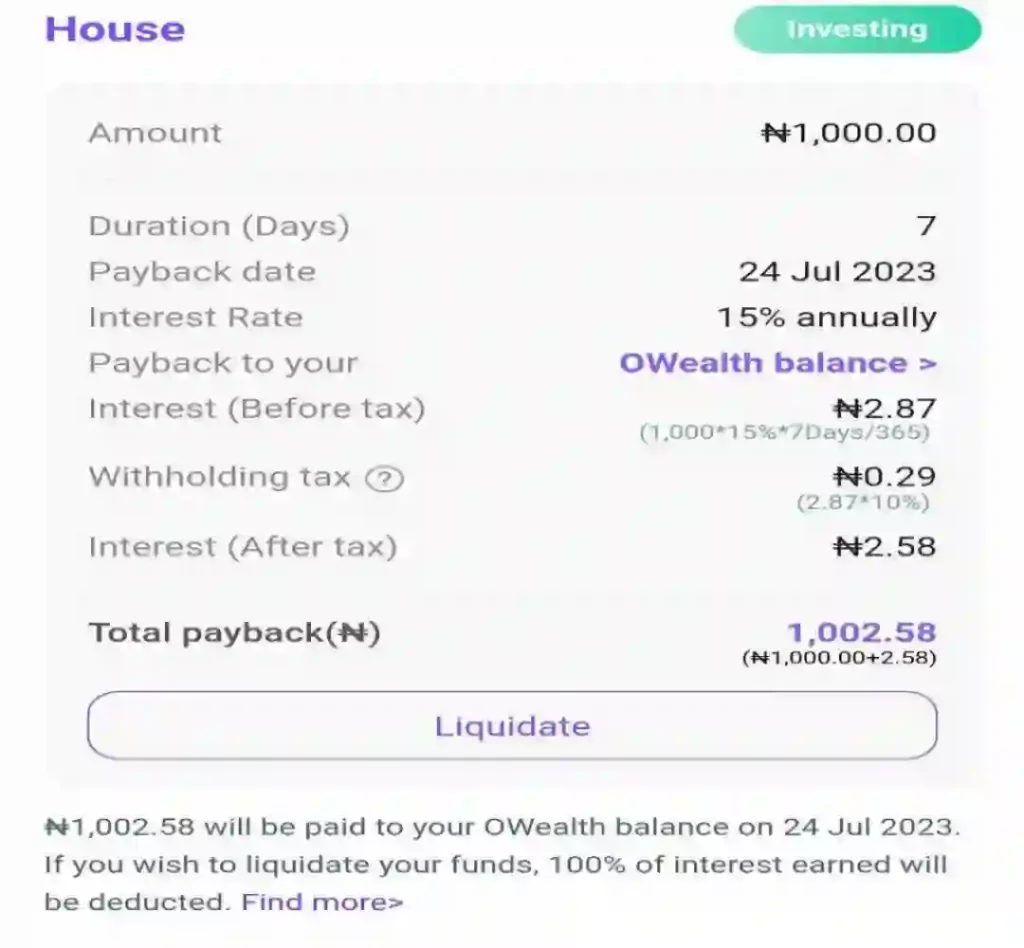

3. You’ll see your active savings, click on the one you want to liquidate, on the next screen click on “Liquidate”

4. You’ll be prompted to select the reason you want to liquidate, just select “Emergency funds” and proceed.

5. Check the details and click on liquidate.

6. Your Fixed savings plan end and your money will be credited to your owealth account within 24 hours.

Click to see how to chat with opay customer care on all their channels if you need help withdrawing your fixed savings, try as much as possible to explain the whole situation to them.

How long do I have to wait to withdraw from Opay fixed savings?

Opay fixed deposit has two modes, locked and unlocked, If you choose to lock your savings, you won’t be able to withdraw it in advance, no matter the circumstances, you will have to wait till the due date in other to withdraw. But if you don’t lock your funds, you can withdraw it at anytime on your opay fixed savings dashboard without any penalty.

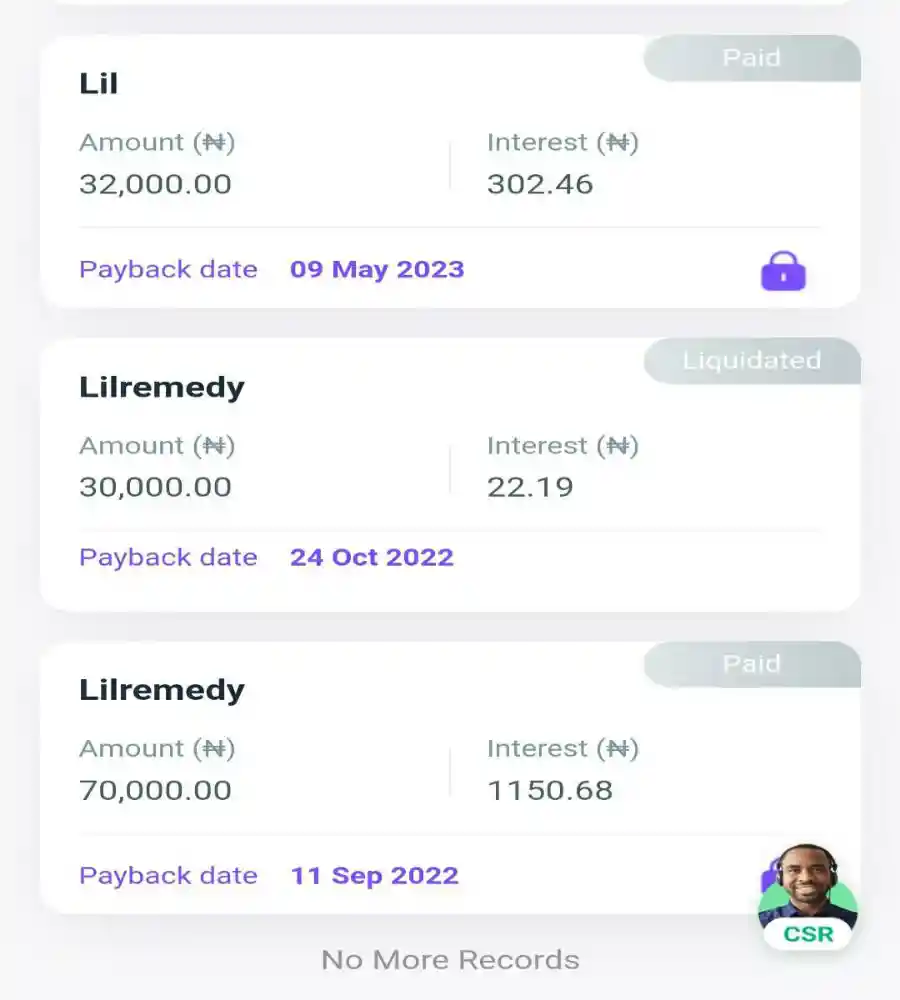

For example, these screenshots below are from my OPay application, i’ve actually used the fixed savings plan three times, on the first occasion, i locked the savings for a period of one month, and coldun’t withdraw till the due date.

Below is a screenshot of my fixed Savings wallet screen, as you can see i’ve used the savings feature on three occasions to save, the first was locked while the other two were unlocked.

Do easy tasks online to earn straight to your naira account: Start Earning

What does liquidating mean on Opay?

When you break your fixed deposit savings plan (withdrawing before due date), the money has to be taken from wherever it was invested for it to get back to you, and this is a complicated process, as the money may have been invested in something that’s not easily accessible, so the process of getting the money to you (making it liquid, making it available in your account so you can use it) is called “LIQUIDATION”.

Withdrawing your fixed deposit in images

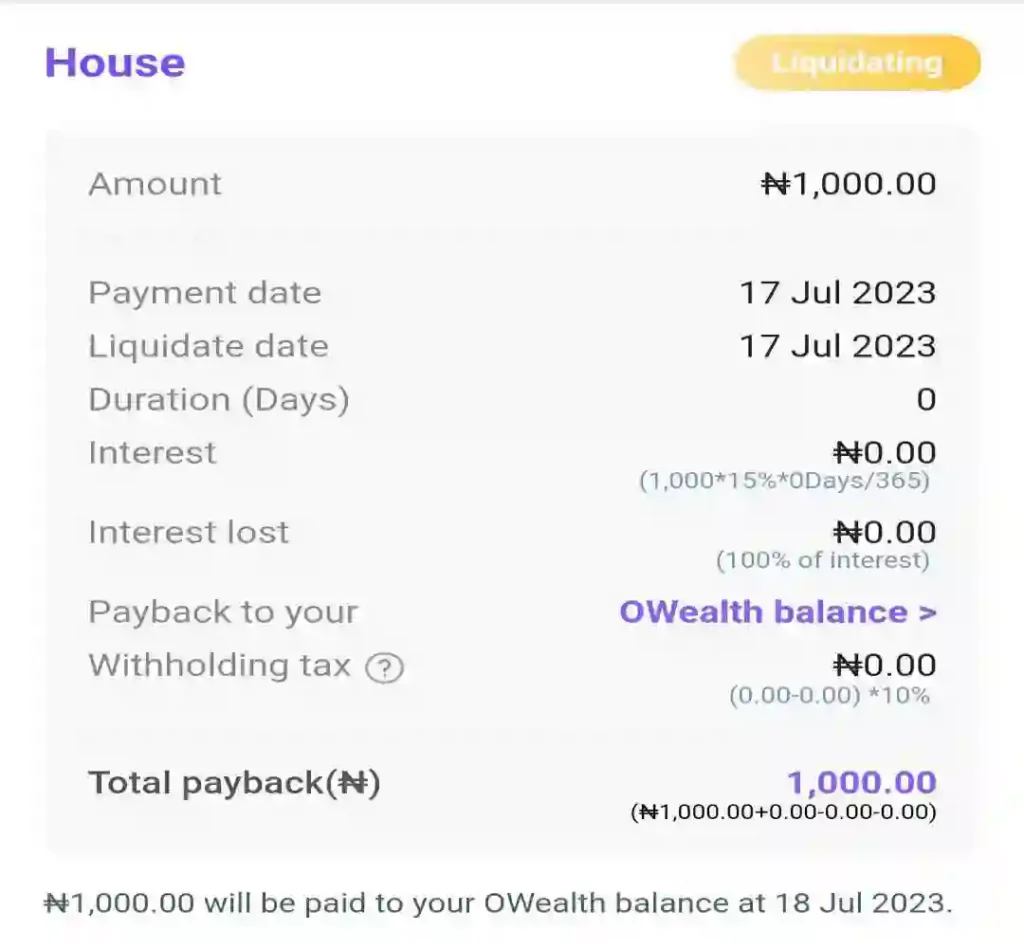

How long does it take before money withdrawn is deposited to my account?

It takes 24 hours and 48 hours at most to receive your liquidated funds to your Opay owealth account.

As you can see in the screenshot above, i initiated withdrawal on 17th July and i received my money on 18th of July.