Nigerians in recent years have start embracing mobile banking solutions and this has been an absolute pain in the ass for the traditional banks who have seen a number of their customers move on to more easy and simpler banking platforms.

Access to high quality savings and investment opportunities is one of the best things challenger banks have brought to the table and in this article we’ll see 10 savings apps offering high interest rates in Nigeria.

Opay

Opay, the biggest fintech platform in Africa with over 20M+ App users is mostly known for its banking services and POS machine, but if you look into the app, you’ll see that there’s a savings feature in the app that enables users to save and earn interest on their money.

Our comprehensive Opay savings review: Fixed, Owealth, Target, Spend & Save: What is Opay Savings?, Interest Rates, FAQs And More

Savings Plans:

Opay gives it’s users the privilege of choosing between 5 different savings plan, namely Owealth, Fixed, Target, Safebox and Spend & Save. All these savings plans has 15% Annual interest, except for fixed savings which goes as high as 18% depending on the number of days and the amount you’re saving.

Each of these plans offers different flavors of savings and using the right one can help you reach your savings goals without breaking your back.

Accessibility & Ease of Use:

Available on Android & iOS.

The savings part of the Opay application is generally easy and straight forward for anyone including novices to use, so if you don’t have any experience saving on an app before, and you want to start your savings journey with Opay, you don’t have much to worry about.

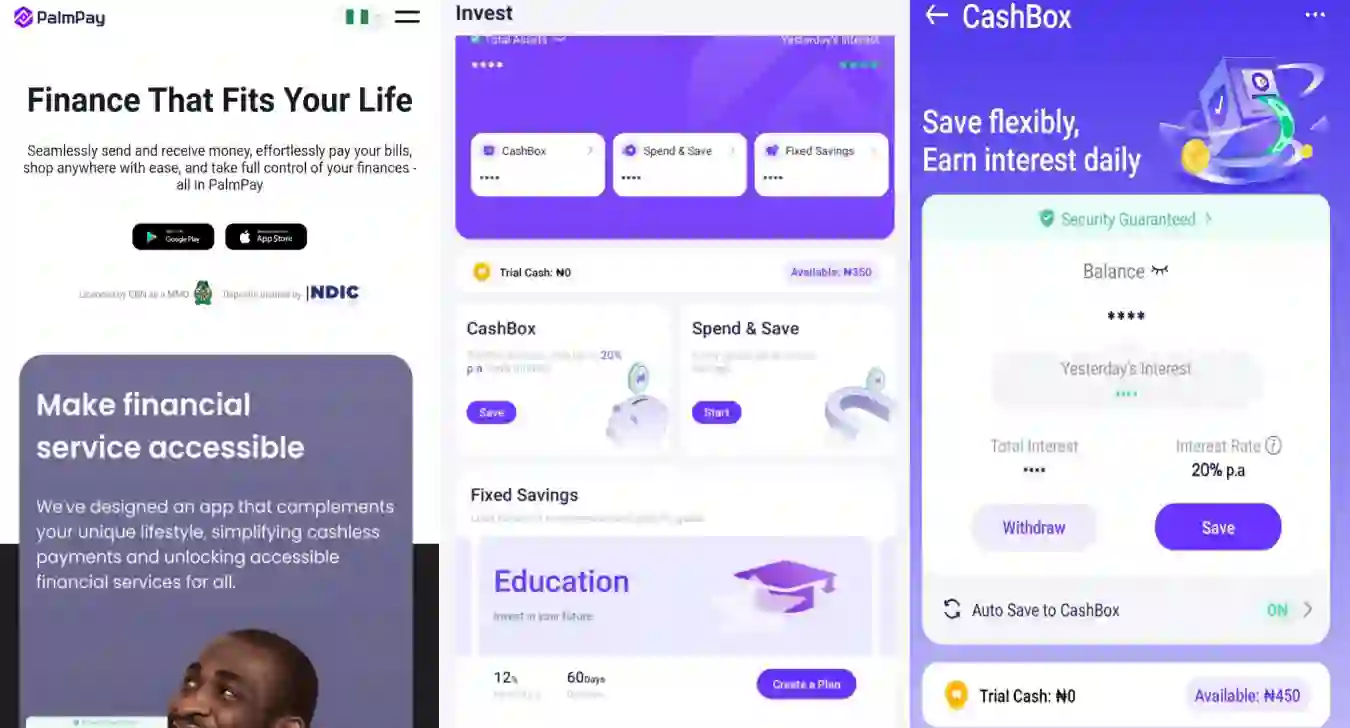

Palmpay

Palmpay is another fintech platform that has totally dominated the Nigerian mobile number money space, with it’s cheaper transaction fees, zero monthly maintenance fees and lightening fast transactions, they have become the go-to app for everyone looking for easy financial live.

They recently launched their savings products and so far, I have found it to be great and working as good as advertised.

Do easy tasks online to earn straight to your naira account: Start Earning

Read our comprehensive Palmpay savings review: Cashbox, Fixed, Spend and Save: Palmpay Savings Review, Interest Rates, FAQs And More

Savings Plans:

Palmpay has 3 savings plans namely, Cashbox, Fixed and Spend & save. The interest rates of these plans ranges from 8% – 20% Annually, except fixed savings which goes from 10% – 20% depending on the number of days you’re saving.

Accessibility & Ease of Use:

Unlock the Secret: How to Earn up to $200+ Daily with Simple Tasks!

Get exclusive access to the platform hundreds of Africans use to make money right from their phone. No experience needed.

Yes, Tell Me More! →Available on Android & iOS.

The savings screen on the palmpay application is easy to access and use, the spend & save screen can be better though. In all you won’t have any major issues creating a savings plan.

Fairmoney

Fairmoney is a very popular and one of the foremost mobile banking app in Nigeria, the launched initially as an emergency loan app, then later moved towards a more all encompassing financial services provider, which they launched their savings products sometime in 2022 and since then the company has been moving steadily and growing strongly in numbers (App users).

Do easy tasks to earn staright to your naira account: Start Earning

Savings Plans:

Fairmoney has three savings mode which are fairsave, fairtarget and fairlock. Fairsave is the normal day to day savings plan that money can be deposited and removed at anytime by the user, fairtarget is for a goal based savings plan where you save towards a goal, while fairlock plan is for users looking to lock up their money for a period of time while earning interest.

interest rates on these plans is 10% per Annum for fairsave and fairtarget and 11% – 24% on fairlock savings mode.

Accessibility & Ease of Use:

Available on Android & iOS.

When it comes to savings with fairmoney, everything is easy and straightforward since there’s not much different modes to look into.

What needs to be looked at is the general network connectivity of the app, as it sometimes fail to open, even with optimal network connection available.

Cowrywise

Unlike Opay & Palmpay, Cowrywise is exclusively for savings and investment, it’s one of the foremost savings app that have garnered the attention and trust of Nigerians, with over 1M+ downloads and several thousands of active users, they have proven that they’re coming to stay.

Savings Plans:

Cowrywise offers a number of different savings plans which includes Emergency savings, Regular savings, Money Duo, savings circle.

You might not have seen fixed savings, well that’s because of their naming convention, the regular savings is what can be termed fixed savings and the emergency savings is the everyday savings plan where you can deposit money as you wish.

Interest rates on these savings are capped at 12% per annum.

Accessibility & Ease of Use:

Avaliable on Android & iOS.

Cowrywise UI/UX is not the best, and can be improved, Even as an experienced app user, I was confused when I first registered and logged in to the app, the welcome/homepage wasn’t showing what was expected and I’m sure many others will be seeing the same as well.

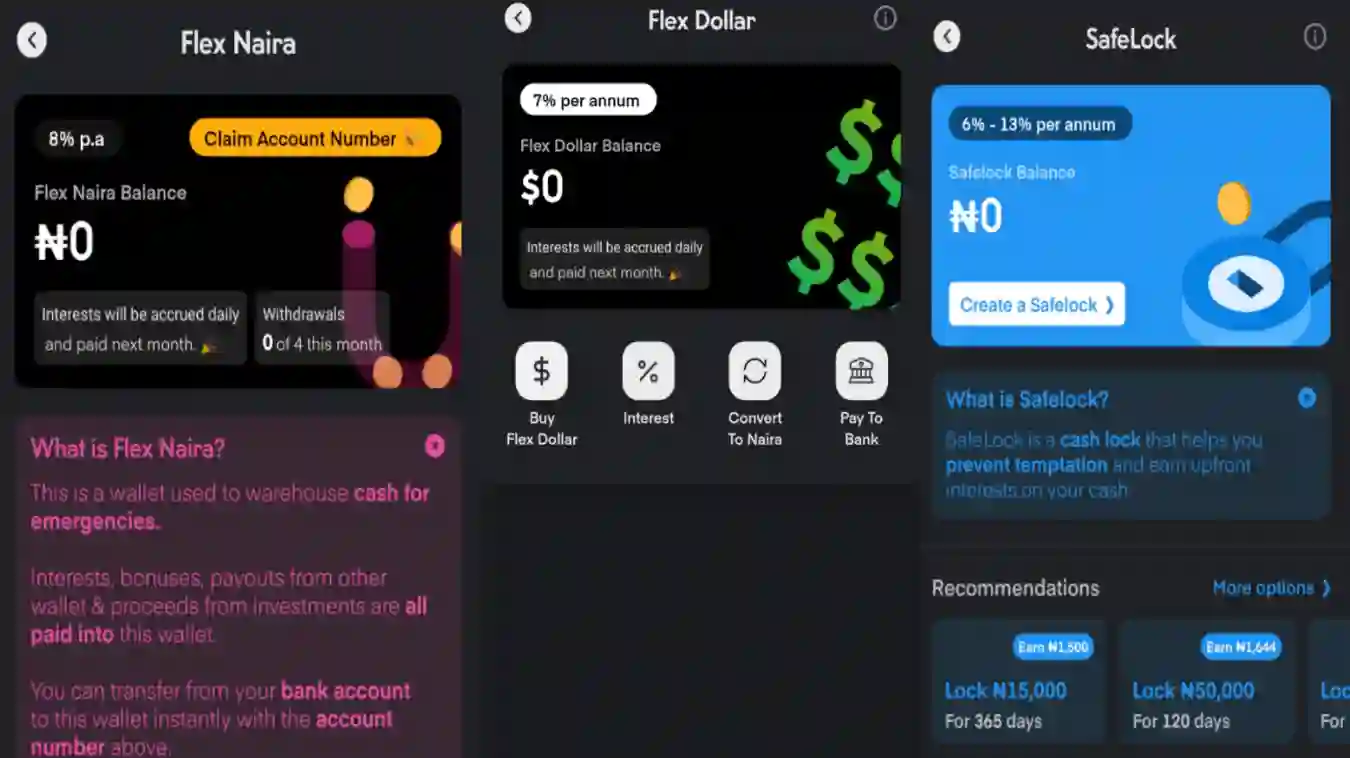

Piggyvest

Like Cowrywise, Piggyvest exists solely for savings and investment, it’s very popular and has been in existence for over 7 years and counting, the platform helps users save and earn some good interest on their money.

Savings Plans:

On Piggyvest you have the freedom of 5 different savings mode, so you can choose the one that’s best suited to your savings need. These include Piggybank, Safelock, Flexnaira, Target savings and flex Dollar.

Interest rate you can expect to earn by saving on any of these plans ranges from 7% to as high as 13% per Annum.

Accessibility & Ease of Use:

Avaliable on Android and iOS.

Piggyvest is one of the nicely designed savings app and it’s usable even for novices trying out fintech savings solutions.

Branch International

Branch international is a well known emergency loan and lending app, it’s has accumulated over 10M+ downloads across mobile download stores.

Like other apps that started with a lending theme, Branch international has added other services including savings products to their platform to make it more useful to the users, while also enabling them to thrive in the competitive market.

Savings Plans:

Branch has 3 types of savings plans, which includes Flexi, Locked savings and Target savings. Interest rates is 10% per annum for flexible savings, while locked and target savings is at 15% per annum.

Accessibility & Ease of Use:

Avaliable on Android only.

Branch app generally offers great experience and their savings product is smooth as well, the interface is good and straight forward, thereby making it easy for anyone looking to start their savings journey.

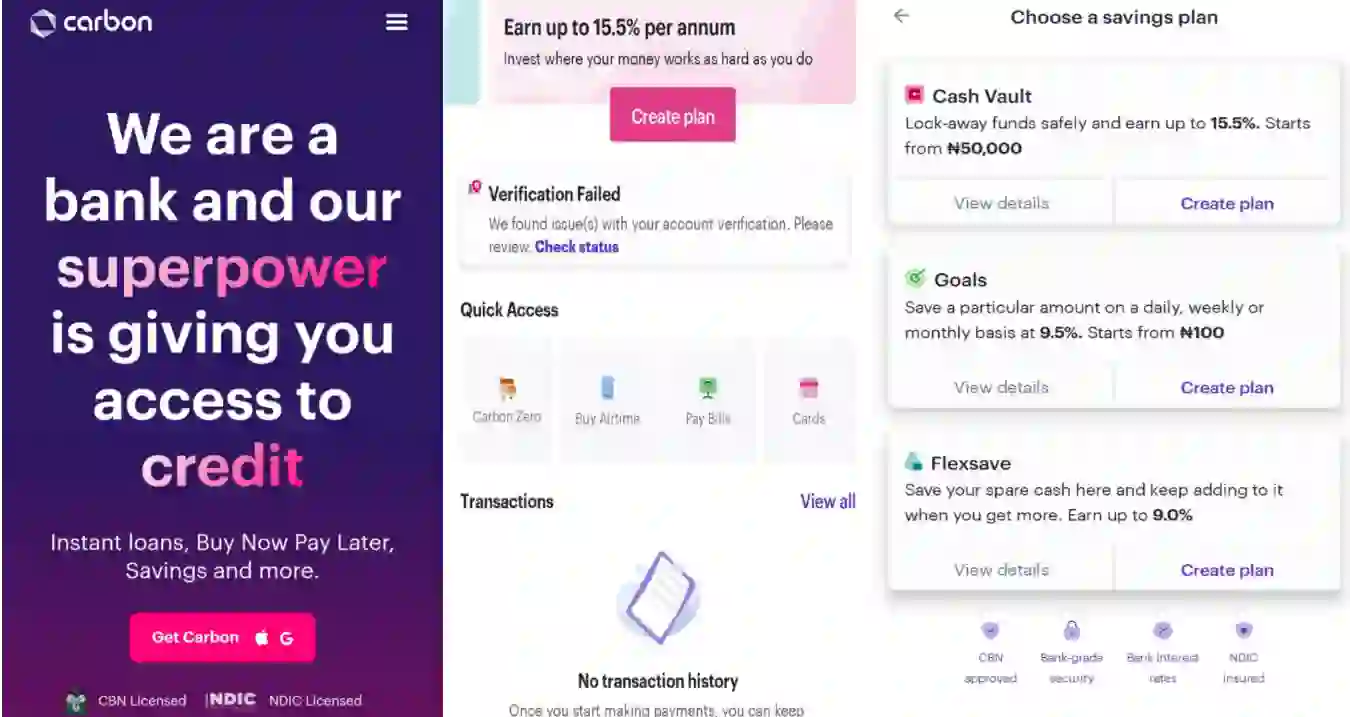

Carbon

Carbon (Fka. Paylater) is another fintech platform that has been around for a long time, initially a lending app, they have grown a lot in the past few years adding several other banking features and currently boasts of over 2 million app downloads and thousands of active app users, carbon deserves it’s place on this list of top savings apps in Nigeria.

Savings Plans:

Carbon has three different savings plans and each carter for different purpose of savings, the “Cash vault” is for people that want to lock their savings, “Goals” is for people looking to save towards a target and lastly there’s the “Flexsave” plan which you can add and remove money as you wish.

Intetrest rates goes up to 15.5% per annum on cashvault, while Goals and Flexsave has interest rates of 9.5% and 9.0% respectively.

Accessibility & Ease of Use:

Avaliable on Android and iOS.

Carbon has a great UI/UX, and as a user, it’s easy to create a savings plan and start your savings journey.

Raven

The newest amongst the fintech solutions mentioned in this article, they have grown very quickly in such a short time they’ve been around, this is evident in that they have accumulated over 500k in downloads on android playstore alone.

Raven is a complete mobile banking application featuring lending and savings as flagship products.

Savings Plans:

As an intending user, you have the privilege of choosing between 4 different savings plans, which are Target, Fixed, Spend & Save and HIFA (High Interest Fixed Accounts).

On the interest side of things you can expect to earn from 5% per annum to as high as 18% per annum, depending on the plan you choose.

Although it’s not a dedicated savings app, it’s still has some of the best Offering.

Accessibility & Ease of Use:

Avaliable on Android & iOS.

Raven has a great modern looking UI and everything ranging from registration to the homepage is easy-going and we’ll placed so you can carry out any banking activities without needing much of external guidance.

V by VFD

Since the launch of the V app on 2020, it has risen sharply to become one of the most used online banking platforms in the country, thanks to it’s comprehensive suit of features that enables users perform all kinds of banking activities on the go.

It’s savings feature is also one of the best, and offers good interest rates.

Savings Plans:

V has three different savings plans, Target, Fixed and crew savings. The names are already self explanatory, you should expect to earn about 9% interest on your Target savings, about 12% on Crew savings and Upto 20% Fixed savings plan, all Annually.

Accessibility & Ease of Use:

Avaliable on Android and iOS.

V App is very clean and comprehensive, but don’t try opening an account at Night as you won’t be able to pass their face verification feature unless you have a very bright room.

Kuda MFB

There was a time kuda was the most popular fintech app in Nigeria, but they couldn’t held on to that postion for long as Opay and Palmpay entered the scene with irisistible features and benefits.

Nevertheless Kuda remains a very strong microfinance bank and still has one of the most used mobile banking application in Nigeria.

Savings Plans:

Kuda has 4 savings plans that are tailored to different savings goals, you can choose “As you want”, “Frequently”, “Spend and save” and “Fixed Deposit”.

Interest rates ranges from 5% for Frequently (Target savings) to about 6.5%- 8% on Fixed deposit plan.

Accessibility & Ease of Use:

Avaliable on Android and iOS.

Kuda microfinance bank has arguably the most appealing and modern interface of any banking app in Nigeria, the savings part is no exception and has a self explanatory interface that’s easy for anyone to start saving.

Rounding Up

You’re at liberty to choose any of these apps for savings, some offers high savings, some are exclusively for savings while others are complete online banking solutions.

The particular app you choose will depend on if you want your savings account to be isolated from your normal daily banking application. Cowrywise and Piggyvest are exclusively for savings, while Opay and Palmpay offers higher interest rates.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

803375 371741Official NFL jerseys, NHL jerseys, Pro and replica jerseys customized with Any Name / Number in Pro-Stitched Tackle Twill. All NHL teams, full range of styles and apparel. Signed NFL NHL player jerseys and custom team hockey and football uniforms 540175

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

688445 780037Thank you pertaining to giving this outstanding content material on your web-site. I discovered it on google. I might check back again if you publish extra aricles. 643887

It’s very effortless to find out any topic on web as compared to

textbooks, as I found this post at this web site.

Nice list but shocked to see Sumotrust is not on your list but Raven is there.

Raven practically copied one of their features into their raven app.