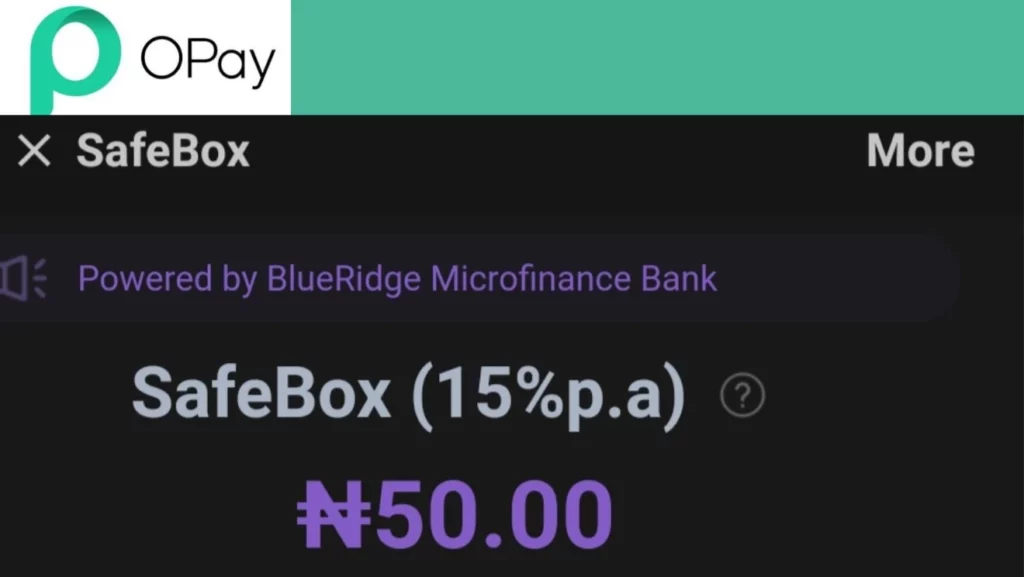

Opay Safebox is a savings plan on the opay application which you can deposit daily, weekly or monthly and earn interest on your savings.

What differentiate it from other opay savings product is that to make a withdrawal before the due date, you’ll have to pay a penalty/breaking fee, this is to promote savings discipline.

Click to read my complete guide that covers all opay savings plans.

How Does Opay Safebox Withdrawal Work

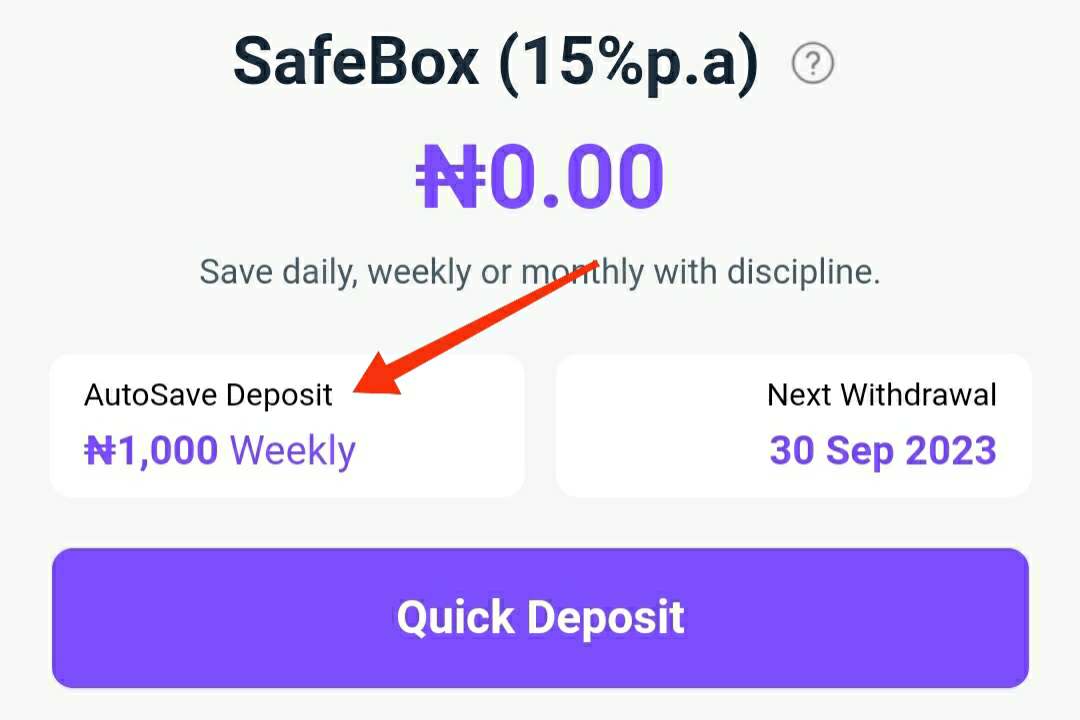

On Safebox you can set the withdrawal date, this is like a maturity date, if you don’t set your own withdrawal date, you can as well withdraw on opay default withdrawal dates, which are march 31st, June 30th, September 30th and December 31st.

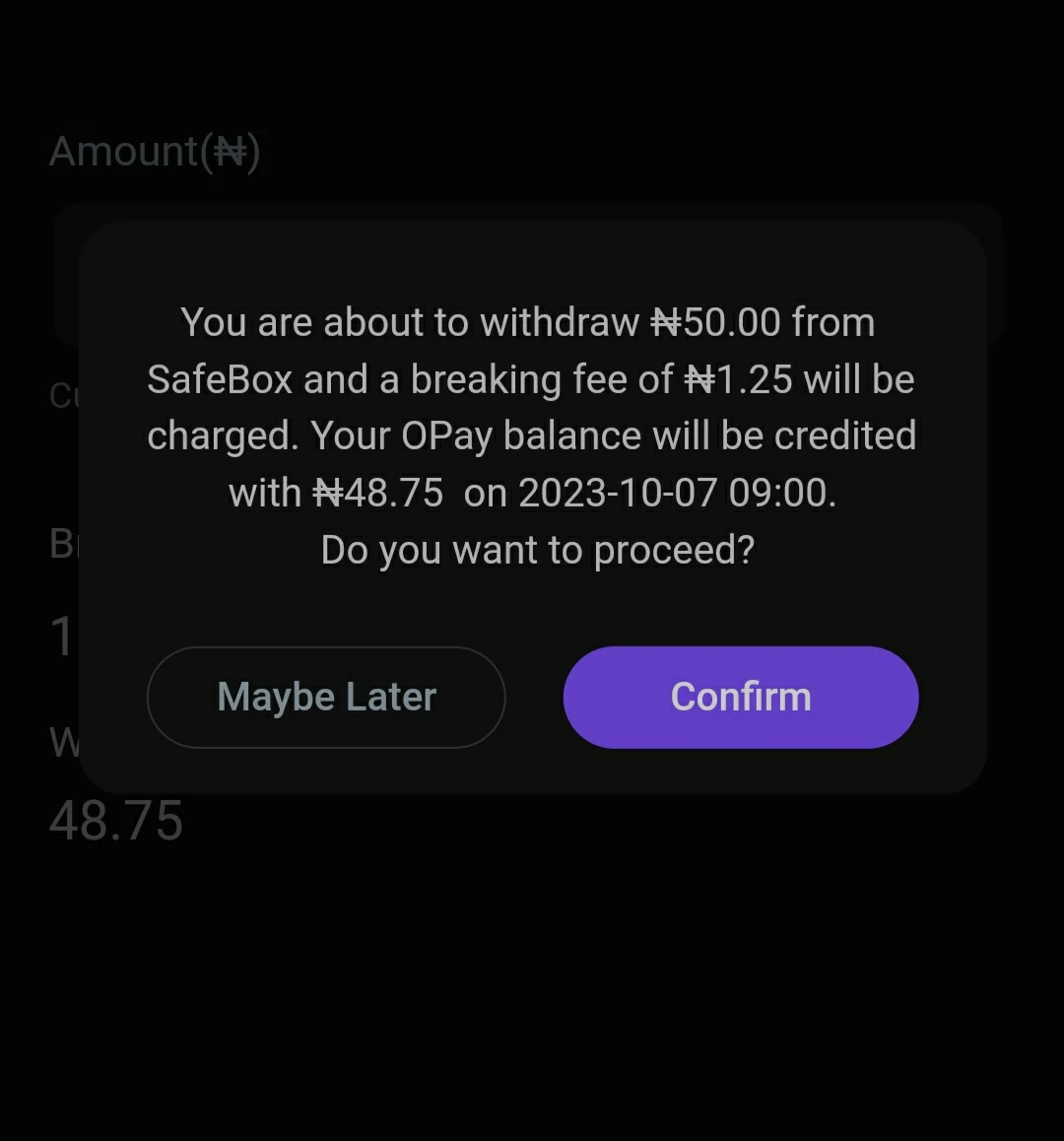

If you withdraw before the withdrawal date that you set, or apart from any of the four dates above, a breaking fee will be charged.

A breaking fee is a charge deducted for requesting a withdrawal on non-withdrawal days. Breaking fees are 2.5% of the withdrawal amount, this is to promote savings discipline and help you meet your savings goals faster.

How to Withdraw from Opay Safebox Account

Withdrawing from Opay Safebox Account is easy, just follow the below steps.

Step 1: Open your Opay application and login to your account.

Step 2: On the bottom of the application, you’ll see “Finance”, click on it.

Step 3: Click on “Safebox” and the dashboard will open.

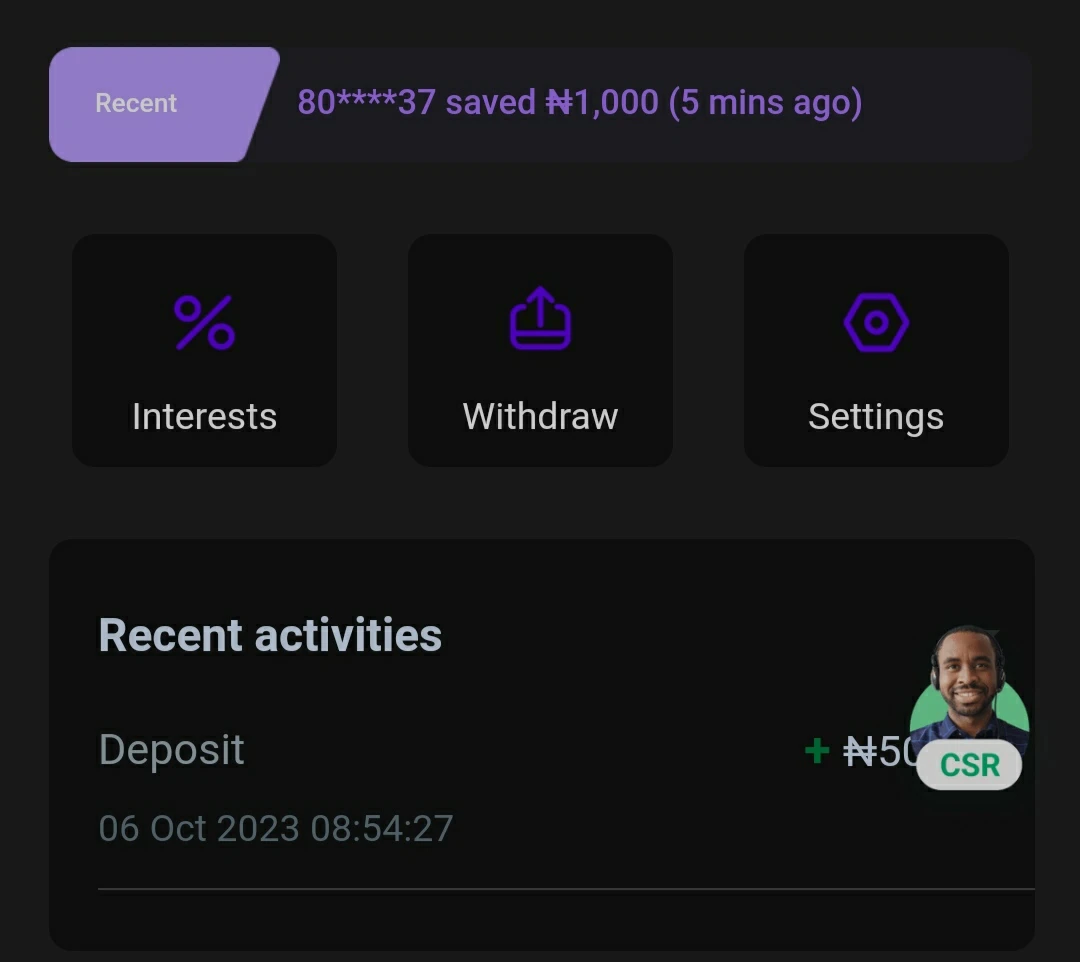

Step 4: Click on “Withdraw”.

Step 5: Enter the withdrawal amount, you’ll be shown the breaking fee, click on “Next”.

Step 6: Confirm your withdrawal, input your Opay transaction pin and click on withdraw.

Do easy tasks online to earn straight to your naira account: Start Earning

Step 7: Your Withdrawal will be processed and the money will be paid to your Opay balance within 24 hours.

How to turn off Autosave Deposit on Opay Safebox?

- On your spend and save screen, click on Autosave deposit.

- Check the bottom of the screen and click on turn off auto save deposit

- Enter payment PIN and confirm.

- That’s all.

Safebox Withdrawal in Screenshot Images

237474 38360Any way Im going to be subscribing for a feed and I hope you write-up once more soon 40342

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

122479 171484Youre so cool! I dont suppose Ive read anything like this before. So nice to locate somebody with some original thoughts on this topic. realy thank you for starting this up. this website is something that is necessary on the web, someone with a little originality. useful job for bringing something new towards the internet! 176972

Hello my family member! I wish to say that this article

is amazing, great written and include approximately all important infos.

I’d like to see more posts like this .