Opay, currently the most popular mobile money operator in Nigeria with over 35M + 500k active users and agents, supports basic functionalities like transfer and bills payments, as well as having sophisticated savings products.

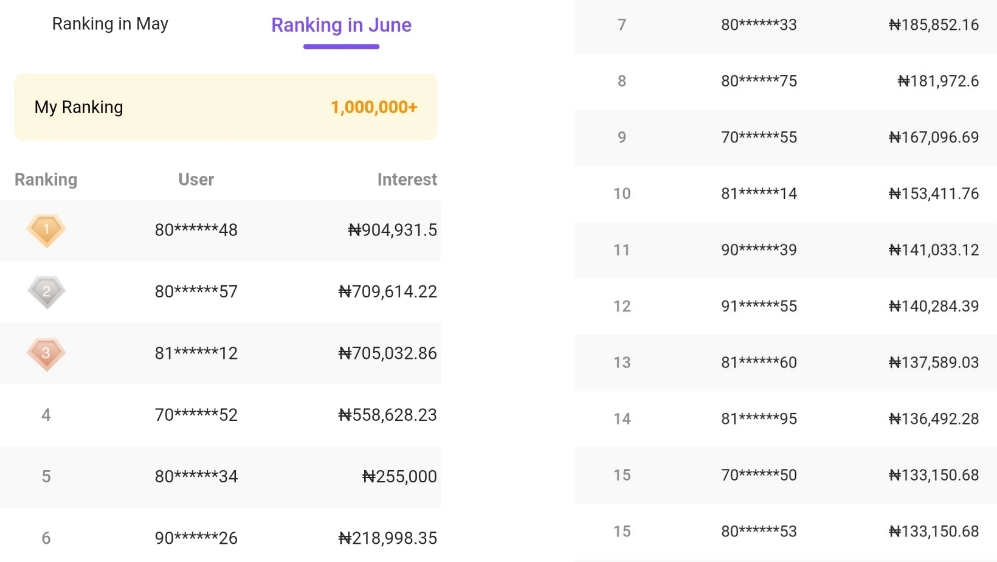

Their saving plans are popular among nigerians and the interest rates are very good. Looking at the screenshot below gotten from their official mobile application, you can see than over a million people are currently saving with opay savings and are earning interests as high as 1 million Naira monthly.

What is opay Savings?

Opay savings is a suite of plans available on the opay mobile application that enables users to save and earn interest on savings while ensuring security, transparency and ease of use.

Opay currently has 5 different savings plan and while they may appear to be much, they’re all unique on their way and offer different varieties to savings.

The plans are:

We’ll start with Owealth, as the most prominent plan and move down till the end, you’ll get to know the different opay savings interest rate for all the savings plan.

Is opay Savings secure & legit?

Opay Savings and its plans are very legit and secure, as OPay is being insured by the National deposit insurance coporation (NDIC) as a verified mobile money operator.

The Nigeria Deposit Insurance Corporation, is an independent agency of the Federal Government of Nigeria. The purpose of the deposit insurance system is to protect depositors and guarantee the settlement of insured funds when a deposit-taking financial institution can no longer repay their deposits, thereby helping to maintain financial system stability.

NDIC

Opay saving plans comparison table

| Intrest | Withdrawal | Penalty | |

| Owealth | 15% | free | null |

| Fixed | 18% | free | null |

| Target | 15% | penalty | 1% of Savings |

| Spend and save | 15% | free | null |

| Safebox | 15% | penalty | 2.5% of withdrawal |

All Opay Saving Plans And Their FAQs

Owealth Savings

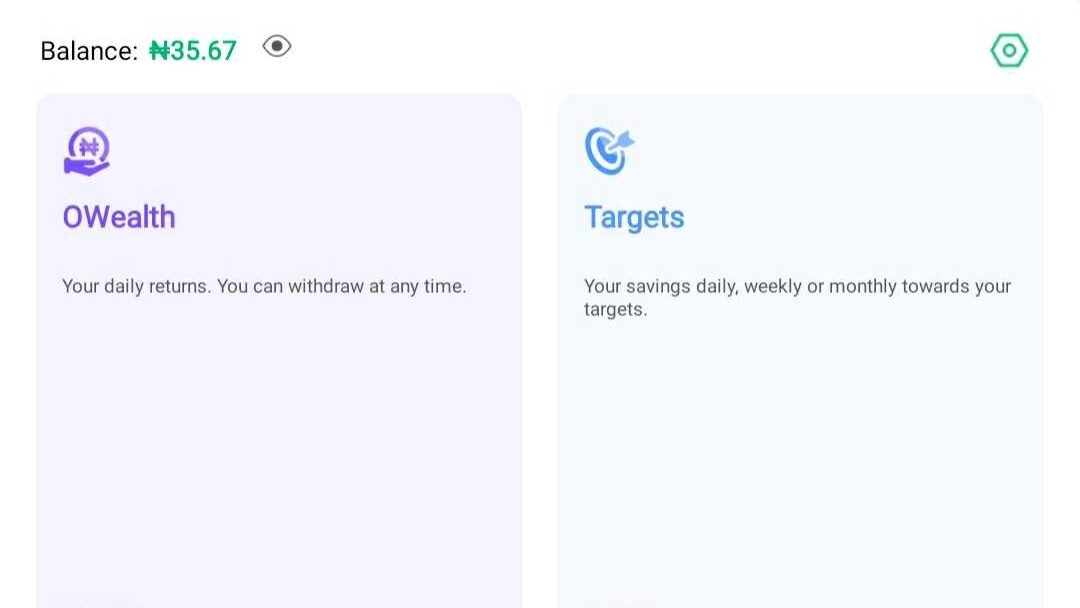

Owealth is the default savings plan on Opay. Here you can save and spend your savings anytime without any restrictions, you also get your interest paid to your account every morning, no matter how big or small you save, you’ll always be paid every morning, so you don’t have to wait till a certain due date to get your interest.

Opay vs Owealth?

The difference between opay and owealth is that opay is the mobile application which you can install on your smartphone and use to carry out several banking operations, while owealth is a savings plan inside the Opay application that enables users to save, spend and withdraw their savings at anytime, flexibly.

How much interest do I earn with Owealth?

With owealth, you get 15% annual interest for savings of N100,000 and below. For savings above N100,000, you’ll get 15% annual interest for the first 100k and 5% interest for the remainder of the savings.

How is Owealth interest paid?

Interest is paid out every morning to your Owealth account, you don’t have to wait till a certain due date, which is great if you want daily interest.

Can i withdraw my Owealth savings anytime?

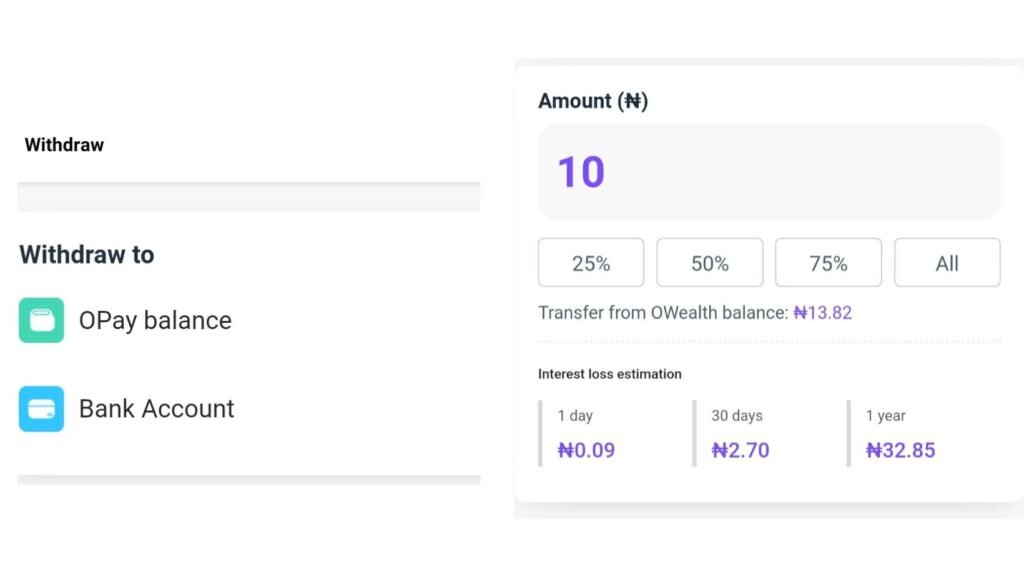

Yes, you can withdraw the savings on your Owealth plan at any time without any penalty or fee. You can also spend the money on owealth without even withdrawing it to your normal opay account.

Do easy tasks online to earn straight to your naira account: Start Earning

Is Owealth legit?

Yes, owealth is legit as it is insured by the National deposit insurance coporation (NDIC), if something ever happens to opay owealth, you’ll be paid your savings upto 500,000 Naira.

How can i deposit on Owealth?

- Open your opay application on either android or iphone

- Check the footer navigation, and click on “finance”

- The savings page will open, check and click on “Owealth”

- Click on “invest”

- Enter the amount you want to invest and “click on confirm”

- You’ll receive a “successful transfer to your Owealth account” message.

- That’s the end.

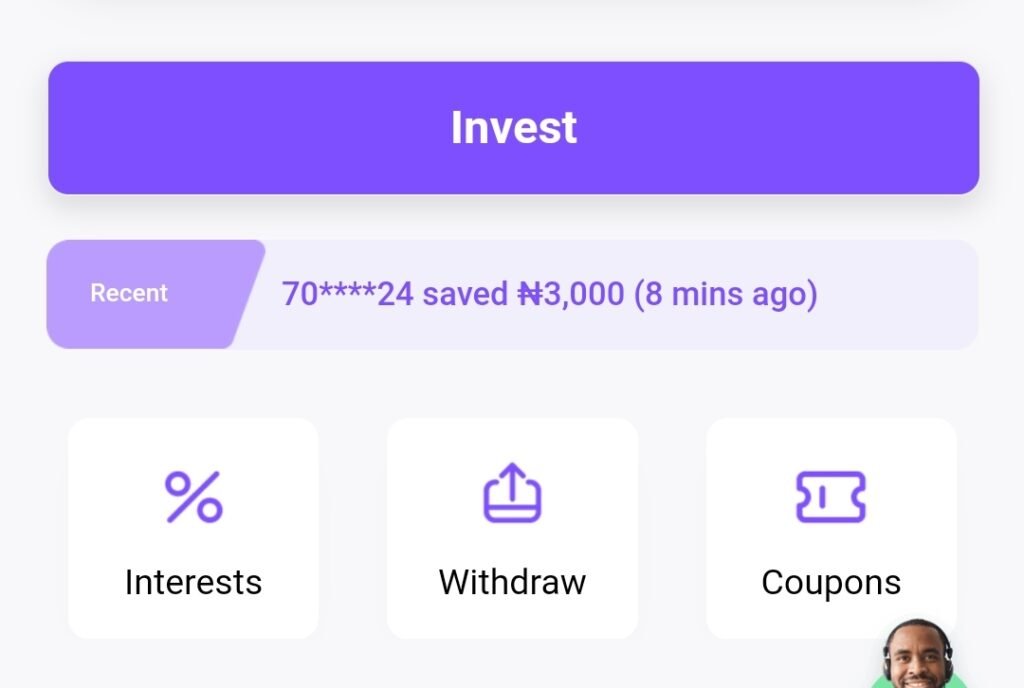

How to withdraw from owealth to opay balance?

To withdraw from owealth to opay:

1. On your Opay app, click on “finance” on the bottom navigation.

2. The savings screen will come up, “click on Owealth”.

Unlock the Secret: How to Earn up to $200+ Daily with Simple Tasks!

Get exclusive access to the platform hundreds of Africans use to make money right from their phone. No experience needed.

Yes, Tell Me More! →

3. On the owealth screen click on “withdraw”

4. Select the account you want to withdraw to, either your Opay account or bank withdrawal and input the amount you want to withdraw.

5. If you want to do bank withdrawal, fill in the account details and confirm the transaction, if you want to transfer to opay balance just click confirm.

Do easy tasks to earn staright to your naira account: Start Earning

6. Click confirm again and transfer.

7. Transfer successful. That’s all.

How to activate automatic deposit on owealth?

1. On your Opay app, click on “finance on the bottom navigation”

2. Click on the “gear icon” on the top right of the screen

3. Click on “automatic investment”

4. Click on “settings“

5. Click on “receive money directly to your opay”

6. Click on “apply”

Pros & Cons of owealth

Pros:

- Interest is paid daily

- No fee or penalty on withdrawal

- You can use the savings on owealth while still earning interest

Cons:

- Not a proper savings plan if you’re looking to save for the future

- Too easy to get your savings and lavish it away.

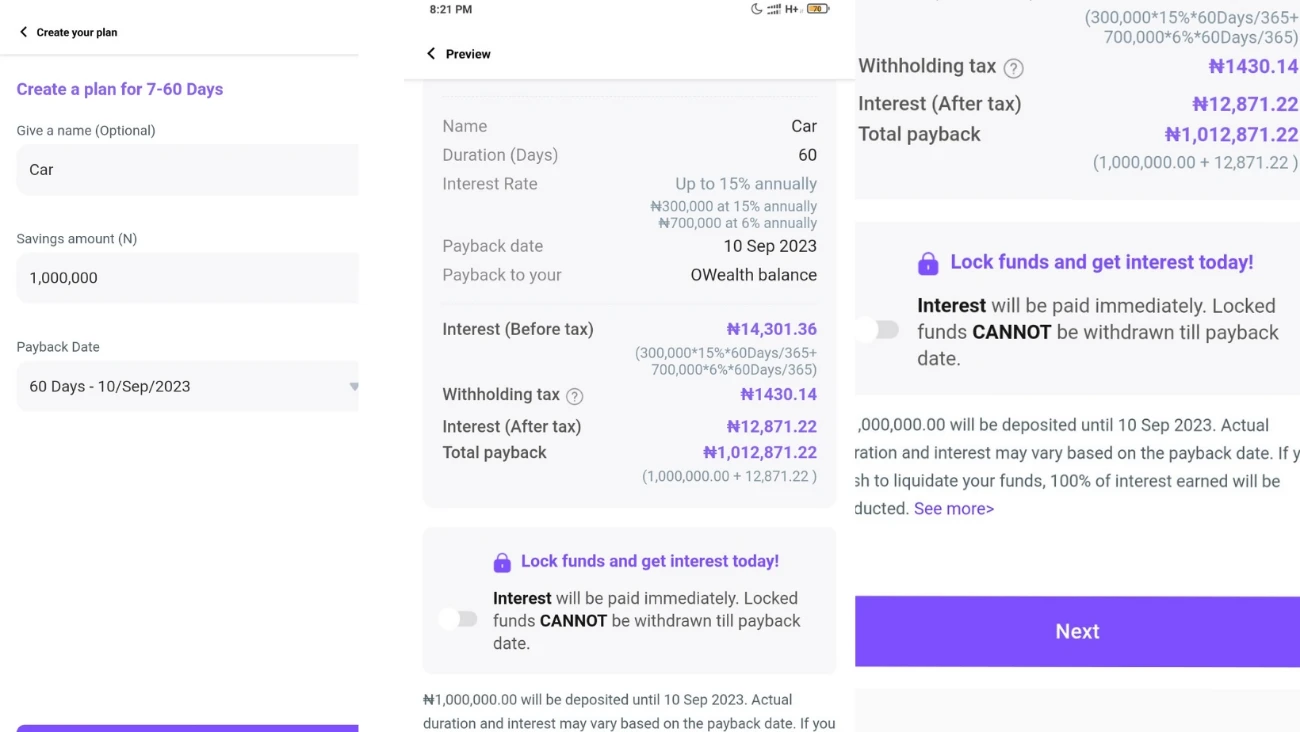

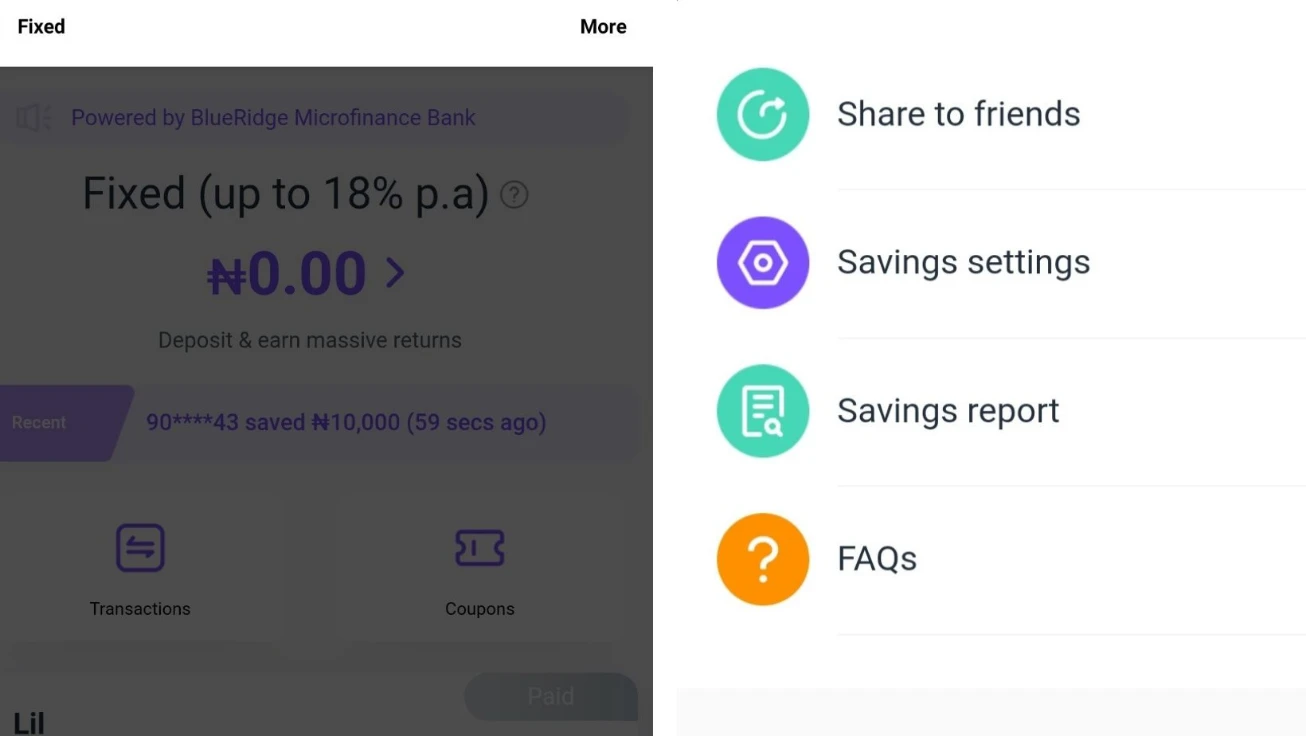

Opay Fixed Savings

Opay fixed savings is a plan that gives you interest on fixed deposit savings, unlike Owealth that interest is paid out daily, fixed savings interest is only paid out on due date along with the principal.

How much interest do I earn with Fixed deposit savings?

For savings of N300,000 and below you’ll be paid 15-18% Annual interest and for savings of N300,000 and above, you’ll be paid interest of 15-18% for the first 300k and 6% interest for the remainder of the money.

Opay Fixed savings intrest table

| Duration (Days) | Balance ≤ N300k | Balance > N300k |

| 7-60 | 15% | 6% |

| 61 – 180 | 16% | 7% |

| 181 -364 | 17% | 8% |

| 365 – 1000 | 18% | 9% |

How does Opay fixed deposit savings works?

Opay Fixed deposit has two modes, locked and unlocked, If you choose to lock your funds when creating your fixed deposit plan, all the interest will be paid to you immediately and your funds will be locked up for the number of days, weeks or months you choose, but if you don’t lock your funds, your interest will be paid at the due date or at anytime you choose to withdraw, If you withdraw early just note that you’ll lose most of your interest.

How can i withdraw the savings on my Opay fixed deposit?

complete guide: How To Withdraw From Opay Fixed Deposit Account (Complete Guide)

Opay fixed deposit has two modes, locked and unlocked, If you choose to lock your savings, you won’t be able to withdraw it in advance, no matter the circumstances, you will have to wait till the due date in other to withdrawn. But if you don’t lock your funds, you can withdraw it at anytime on your opay fixed savings dashboard without any penalty.

How can i deposit on Opay fixed savings plan?

- Open your Opay application on either iphone or android

- On the footer navigation click on “finance”

- The savings page will open, click on “fixed”

- Click on “create a plan”

- Select the duration period, eg 30-60 days, 60-300 days, 300 days to 1000 days.

- Fill in the appropriate details, like amount and also select whether it will be locked or unlocked and click next

- You’ll be shown a payment page, which you can use either your opay account, Owealth, ATM card or bank deposit to make the payment.

- If successful, your plan will be created.

Opay Target Savings

Opay target savings plan allows you to create a daily, weekly or monthly savings plan. With this you’re saving for a specific target, which can be School fee, accomodations, gadget, and so on.

How does Opay Target savings work?

In opay target target savings, you first have to create a plan and set your target, (E.g, saving N50,000 in 100 days), that’ll be your target, You can now choose to either pay daily, weekly or monthly to reach the target, so no matter how much you’re depositing from time to time, at the end, the aim is to reach the target

How much interest do I earn with Target savings?

For savings balance N300,000 and below you’ll be paid 15% Annual interest. For savings N300,000 and above, you’ll be paid interest of 15% for the first 300k and 6% interest for the remainder of the money.

How is Target savings interest paid?

Interest will be paid on the day of maturity along with your savings, but note that if you don’t reach your target, all the interest earned will be seized, this is a motivation for you to try as much as possible to reach your target.

How to create an Opay Target savings plan

- Open your opay wallet application

- On the footer navigation, click on finance

- Click on target savings

- Click on a goal(purpose of saving) and click on proceed

- Enter the name of plan and amount you want to invest

- Fill in all the details accordingly and create the savings plan.

- The money will always be deducted automatically on the date and time you’ve set while creating your savings plan, (E.g, 9pm every sunday)

How Can i withdraw the savings on my OPay Target savings ?

- Open your Opay application and click on finance on the bottom navigation.

- Click on Target and proceed.

- On the target screen, it will show all the target plans you’ve created.

- Click on the one you want to withdraw.

- On the screen that opens, click on “break”.

- Select the reason you want to break and confirm by typing your PIN.

- Your money will be sent your owealth account.

Note: In target savings, if you decide to withdraw in advance, no interest will be paid, and a liquidation fee of 1% on the withdrawal amount will charged, this is to enforce savings discipline.

Will I be paid interest if I don’t reach the Target?

No, If at maturity you didn’t reach your target, no interest will be paid. So you must try as much as possible to reach your target.

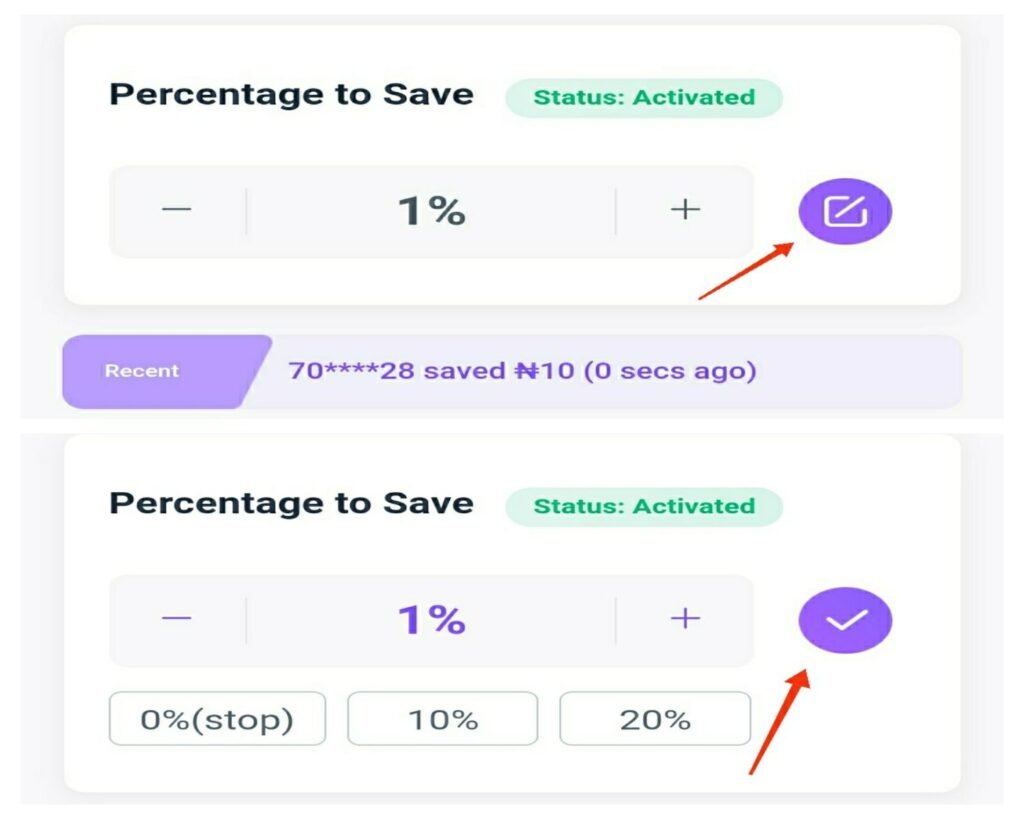

Opay Spend and save

Opay spend and save is a savings plan that encourages users to save a percentage of any amount they spend. Let’s say you set the percentage to 5%, you’ll effectively be saving 5% of any money you spend from your opay account.

How does Opay spend and save work?

It works by you setting a savings percentage and then hitting the “Activate Spend & Save” button. Every time you spend or transfer money on the OPay app, funds are immediately transferred from your OPay Balance to your Spend & Save balance.

Amount automatically transferred = Amount spent * Savings percentage.

Airtime, TV, Electricity, Mobile Data, Betting, Transportation, and Waste Bill Payment are all examples of “Spend” in this sense.

“Transfer” refers to transfers to other bank accounts as well as OPay accounts.

How much interest do I earn with spend and save?

15% interest paid anually, interest is accumulated daily.

How can I cancel spend and save plan?

You can cancel anytime, by setting percentage the percentage on the spend and save screen to 0%.

Can i withdraw the savings on my spend and save anytime?

You can Withdraw spend and save savings anytime, when you cancel it, without any penalty.

How can i activate spend & save on Opay?

- Open your opay application on either android or iphone.

- Check the footer navigation, and click on “finance”

- The savings page will open, check and click on “Spend & Save”.

- Locate and click on “edit icon” beside the “0%”, see the screenshot above.

- Enter the percentage you want to be saving, for every time you spend, example 5%.

- Click the “✔️tick icon” to save.

- That’s the end.

I activated the spend and save in the Opay app, but it’s not saving money while I spend or transfer, What should I do?

If you have activated spend and save but it is not working, then you have to actually wait as this a not a problem from your side, it is a bug from the opay application and it needs to be fixed.

I’ve reached out to opay on twitter concerning this and they’ve promised to fix it, So you have to exercise patience.

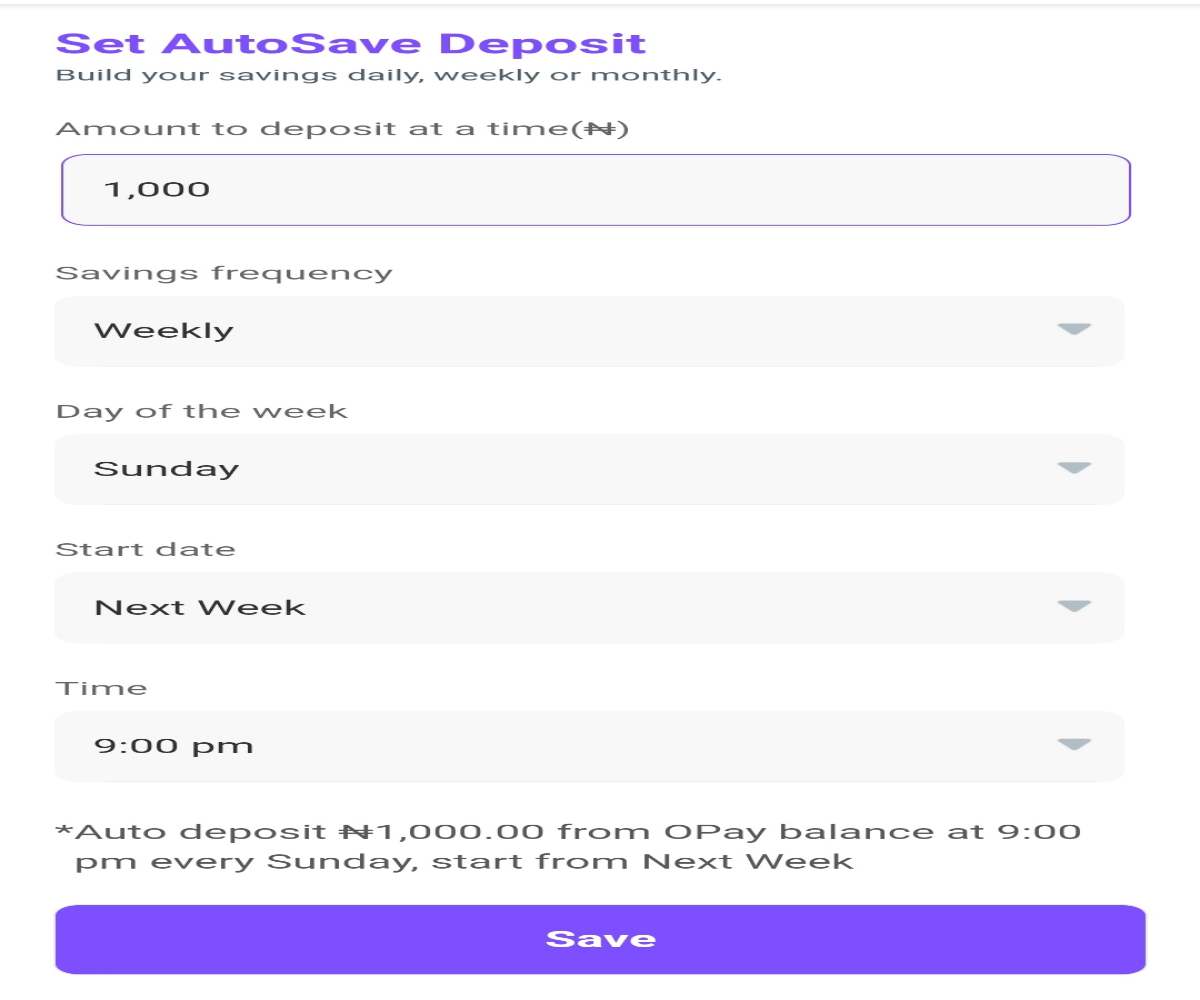

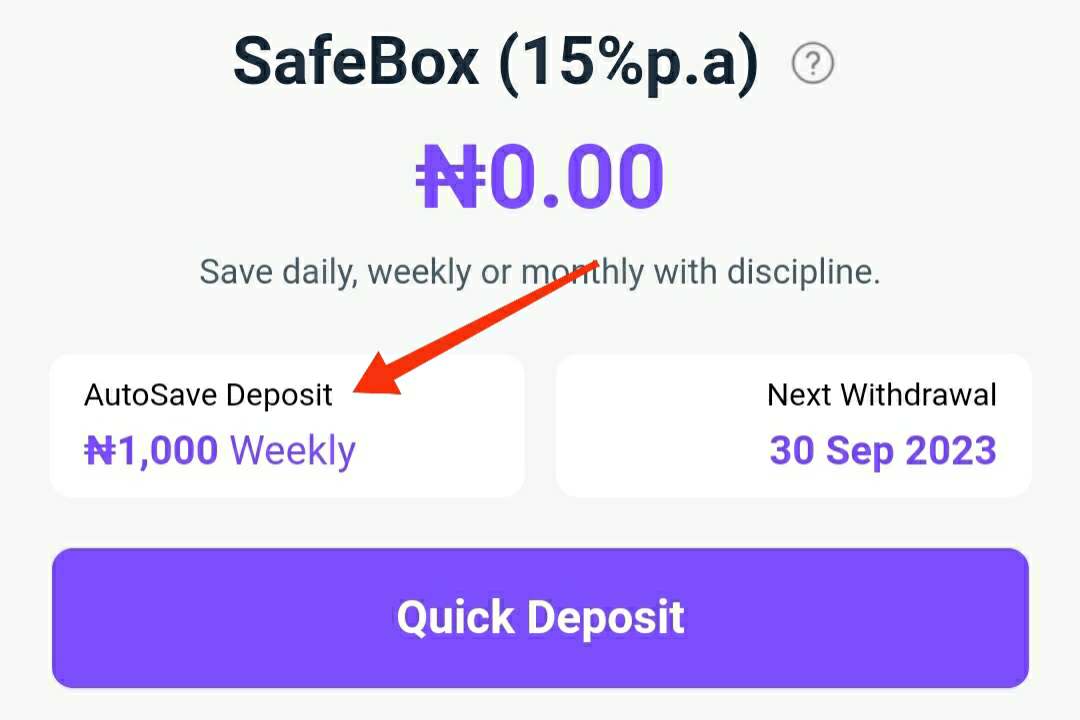

Opay Safebox Savings

Opay Safebox is a savings plan on opay which you can deposit daily, weekly or monthly and earn interest on your savings as you save. The catch here is that to make any withdrawal you’ll have to pay a penalty/breaking fee for withdrawing before the due date. This is to promote savings discipline.

How much interest do i earn with safebox?

For savings balance N300,000 and below you’ll be paid 15% Annual interest. For savings N300,000 and above, you’ll be paid interest of 15% for the first 300k and 6% interest for the remainder of the money.

How is safebox interest paid?

Interest is accumulated daily to your Safebox account, but only paid out to you monthly.

How can i withdraw the savings on my safebox?

You can set the withdrawal date, this is like a maturity date, or you can withdraw on opay default withdrawal dates, which are march 31st, June 30th, September 30th and December 31st.

If you withdraw before the withdrawal date that you set, or apart from any of the four dates above, a breaking fee will be charged. A Breaking fee is a charge deducted for requesting a withdrawal on non-withdrawal days. Breaking fees are 2.5% of the withdrawal amount, This is to promote savings discipline and help you meet your savings goals faster.

How can i deposit on Opay safebox?

- Open your opay application on your smartphone

- Check the footer navigation, and click on “finance”

- The savings page will open, check and click on “Safebox”

- Click on “Turn on auto save deposit”

- Enter the amount you want to invest, select frequency either daily, weekly or monthly, day of the week, starting date and time and “click on save”

- Enter your payment PIN and confirm.

- That’s the end.

How to turn off autosave deposit on opay Safebox?

- On your spend and save screen, click on Autosave deposit.

- Check the bottom of the screen and click on turn off auto save deposit

- Enter payment PIN and confirm.

- That’s all.

How to see all the terms and conditions of each opay saving plan

To see all terms of each opay Saving plan,

- On the opay application, click on finance on the bottom navigation.

- Click any saving plan and click on “more” on the top right

- Click on FAQs

Rounding Up

Opay offers a range of savings plans that cater to the diverse needs of its users in Nigeria. The Owealth plan, with its daily interest payments and easy accessibility, is a popular choice for many.

The Fixed savings plan provides higher interest rates for those looking to lock in their savings for a specific period. The Target savings plan motivates users to reach their savings goals by offering interest payments upon maturity.

The Spend and Save plan encourages users to save a percentage of their spending, while the Safebox plan promotes savings discipline with penalty fees for early withdrawals. With the assurance of being insured by the NDIC, Opay’s savings plans provide secure and legitimate options for everyone looking to grow their savings.

Read also: Cashbox, Fixed: Palmpay Savings Review, Interest Rates, FAQs And More

Read also: FCMB Internet Banking Business Version Login

Great insights on Opay Savings! I appreciate the detailed breakdown of interest rates and the comparison with other savings options. The FAQs section really helped clarify some of my questions. Looking forward to trying it out!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the comparison with traditional banks. It really helped clarify how this platform can benefit savers. Looking forward to seeing how the market evolves!

If you’re looking for the most exciting and reliable casino game platforms in Pakistan, this site truly stands out with its smooth gameplay, fast loading speed, and a wide variety of slot and live casino options. I was impressed by how well it works on mobile devices, which makes it perfect for players who enjoy gaming on the go. The secure payment methods and user-friendly interface build strong trust for new users. Whether you’re a beginner or an experienced player, the bonuses and regular updates keep the experience fresh and rewarding. Highly recommended for anyone in Pakistan searching for safe, entertaining, and high-quality online casino games.

Very efficiently written article. It will be useful to anyone who usess it, including myself. Keep doing what you are doing – for sure i will check out more posts.

Great post! I found the breakdown of Opay Savings really helpful, especially the comparison of interest rates with other savings options. The FAQs section answered most of my questions. Looking forward to seeing how Opay evolves in the savings space!

SPLKPM Malaysia education sector ka aham digital platform hai. SPLKPM login se guru apna CPD data manage karte hain. SPKLM search karne walon ke liye yeh page clear aur user friendly maloomat deta hai.

Great post! I found the breakdown of Opay Savings really helpful, especially the comparison of interest rates. It answered a lot of my questions, and I appreciate the detailed FAQs section. Looking forward to trying it out!

Hello .!

I came across a 158 interesting page that I think you should browse.

This resource is packed with a lot of useful information that you might find insightful.

It has everything you could possibly need, so be sure to give it a visit!

[url=https://jornaluniao.com.br/noticias/turismo/dicas-para-viajar-para-o-brasil-o-que-ver-comer-e-fazer/]https://jornaluniao.com.br/noticias/turismo/dicas-para-viajar-para-o-brasil-o-que-ver-comer-e-fazer/[/url]

Additionally remember not to neglect, guys, that one always may inside this particular piece discover responses for the most most complicated inquiries. We attempted — lay out the complete data via an very easy-to-grasp method.

I found this post really informative! It’s great to see a detailed breakdown of Opay Savings and the different interest rates available. The FAQs section was particularly helpful in clarifying some of my questions. I’m curious to see how these options compare to other savings apps out there!

This post really clarified the differences between Owealth and Opay Savings! I appreciate the breakdown of interest rates and the FAQs section; it answered a lot of my questions. I’m excited to explore these savings options further!

Great insights on Opay Savings! I had no idea about the different interest rates available and how they stack up against traditional savings options. The FAQs section was particularly helpful in clarifying some of my doubts. Looking forward to seeing how this evolves!

I found this post incredibly informative! The breakdown of Opay Savings and the comparison of interest rates was particularly helpful. It clarified a lot of my questions about how their savings options work. I’m also glad to see the FAQs section included—it answered some of my lingering concerns. Great job!

Great breakdown of Opay Savings! I’m particularly interested in the interest rates you mentioned. It would be helpful to see some comparisons with other savings options out there. Thanks for the informative post!

RR3 game is an exciting game where luck and strategy come together. It offers smooth gameplay, attractive graphics, and instant rewards giving players a thrilling and engaging experience.

Futbol libre tv permite a los aficionados disfrutar de fútbol en línea de forma sencilla. Gracias a fútbol libre y futbollibre, es posible seguir partidos importantes, competiciones internacionales y eventos deportivos sin depender de servicios tradicionales de televisión.

Fútbol libre se ha convertido en una opción popular para ver partidos online. A través de futbol libre tv, los usuarios pueden seguir encuentros deportivos desde cualquier lugar, mientras futbollibre gana relevancia como término clave en búsquedas relacionadas con fútbol.

This post on Opay Savings is incredibly insightful! I had no idea about the varying interest rates and the different options available. The FAQs section cleared up a lot of my questions. I’m definitely considering using Opay for my savings now!

In Pakistan, online casinos are not officially licensed by the government. That means players use such platforms at their own responsibility. Many people still play, but there is no legal protection if problems occur.

Great insights on Opay Savings! The breakdown of interest rates and features was really helpful. I’m especially intrigued by the savings target feature—seems like a smart way to keep track of my goals. Looking forward to trying it out!

This post provides a comprehensive overview of Opay Savings! I appreciate the clarity around the interest rates and the FAQs section. It’s helpful to see how it compares to other savings options. Looking forward to trying it out!

PK11 is an exciting online game where players test their luck and skills to win big rewards.

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQs section. It’s really helpful for understanding how to maximize savings through their platform. Looking forward to more updates!

I have observed that in the world of today, video games would be the latest popularity with children of all ages. There are occassions when it may be extremely hard to drag your kids away from the video games. If you want the best of both worlds, there are many educational gaming activities for kids. Great post.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Great post! I found the breakdown of Opay Savings and the interest rates really helpful. It’s interesting how the platform is making saving more accessible. I have a couple of questions—how frequently are the interest payments made, and are there any limits on how much I can deposit? Thanks!

Great post! I found the comparison between Opay Savings and traditional savings accounts really insightful. The interest rates you highlighted seem competitive, and I appreciate the breakdown of the FAQs. I’m curious to see how this service evolves in the coming months!

Mobile gaming is growing fast in Pakistan, and people of all ages now enjoy playing games on their smartphones. Among many Android games, one name that is becoming very popular is Lucky PKR777. This game is designed for users who want entertainment, fun challenges, and a smooth mobile experience all in one place.

The WE999 Game is an Android entertainment application designed for mobile users who enjoy playing interactive and skill-based games. It provides a clean interface, fast loading speed, and multiple game options inside one app. Whether you are new to mobile gaming or already experienced, WE999 gives a smooth and enjoyable experience.

This blog post was super informative! I appreciate the breakdown of Opay Savings and the comparison with other options like Target and Fixed. The FAQs section really clarified a lot of my questions, especially about interest rates. Looking forward to trying out Opay Savings!

Great breakdown of Opay Savings! I appreciate the clarity on interest rates and the comparison with other platforms. It’s exciting to see more options for saving. I’m curious about the withdrawal process—how does it work if I need to access my funds quickly?

Great breakdown of Opay Savings! I appreciate the clarity on interest rates and the comparison with other savings options. The FAQs section was really helpful in addressing common concerns. Looking forward to seeing how these savings products evolve!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and how it compares to traditional options. The FAQs section was particularly helpful in clarifying some of my questions. Looking forward to seeing how this evolves!

Apktool is a powerful open-source tool used for reverse engineering Android applications. It allows developers and security researchers to decode APK files into readable resources, such as XML files and images, and then rebuild them after making modifications. Apktool is commonly used for analyzing app behavior, debugging, localization, and learning how Android apps are structured, without needing the original source code.

Your article helped me a lot, is there any more related content? Thanks!

I really found this post insightful! The breakdown of Opay Savings and how their interest rates compare to others was super helpful. It’s great to understand the FAQs and key features in one place. Looking forward to trying it out!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Great overview of Opay Savings! I found the comparison between the different savings options really helpful, especially the breakdown of interest rates. It’s interesting to see how they stack up against traditional banks. I’m curious about any hidden fees—do you think it’s worth switching over?

Excellent, what a website it is! This web site presents useful information to us, keep it up.

Its like you read my mind! You appear to know so much about this, like you wrote the book

in it or something. I think that you could do with some pics to drive the message home a little bit, but instead of

that, this is excellent blog. A fantastic read.

I will certainly be back.

Incredible points. Sound arguments. Keep up

the great effort.

Have you ever thought about including a little bit more than just your articles?

I mean, what you say is fundamental and everything. But think of

if you added some great photos or videos to give your

posts more, “pop”! Your content is excellent but with images and clips, this blog could undeniably be one of the greatest in its niche.

Good blog!

Hi would you mind letting me know which webhost you’re using?

I’ve loaded your blog in 3 different web browsers and I must say

this blog loads a lot quicker then most. Can you suggest a good hosting provider at a reasonable price?

Thank you, I appreciate it!

It’s very straightforward to find out any topic on net as compared to

books, as I found this post at this site.

I am in fact pleased to read this blog posts which carries

tons of helpful facts, thanks for providing such data.

Hey! I’m at work surfing around your blog from my

new iphone! Just wanted to say I love reading

through your blog and look forward to all your posts!

Keep up the great work!

Hi there to every body, it’s my first pay a visit

of this webpage; this website contains remarkable and in fact excellent material for visitors.

This blog post really helped clarify what Opay Savings is all about! I appreciate the detailed breakdown of interest rates and how it compares with other savings options. The FAQs section answered a lot of my questions, too. I’m definitely considering trying it out!

Hi! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard

on. Any suggestions?

I’m excited to uncover this great site. I wanted to thank you for ones time for this fantastic read!!

I definitely liked every bit of it and i also have you saved as a favorite to see new stuff in your web site.

I’ve learn a few excellent stuff here. Definitely value bookmarking for revisiting.

I surprise how much attempt you set to make this type of fantastic informative web site.

I found this post on Opay Savings really informative! The breakdown of interest rates and the comparison with other savings options like Target and Fixed accounts was especially helpful. I appreciate the detailed FAQs as they answered a lot of my questions. Looking forward to seeing how my savings can grow with Opay!

I am sure this paragraph has touched all the internet visitors, its really really fastidious paragraph on building up new weblog.

Great post! I appreciate the detailed breakdown of Opay Savings and the different target interest rates. It’s really helpful to have all the FAQs answered in one place. I’m curious about the safety measures Opay has in place for savings. Looking forward to more insights!

Great insights on Opay Savings! I appreciate the detailed breakdown of interest rates and how it compares to other savings options. The FAQs section was especially helpful in clearing up some of my uncertainties. Looking forward to more posts like this!

Wonderful blog! I found it while surfing around on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Thank you

This blog post really clarified a lot about Opay Savings and the interest rates involved. I particularly appreciated the FAQs section; it answered some questions I had about the process. Excited to explore more about how I can maximize my savings through their platform!

Great insights on Opay Savings! I’m particularly intrigued by the interest rates compared to other options in the market. Looking forward to seeing how it performs over time. Thanks for breaking down the FAQs—it really helps clarify the service for potential users!

This post provided a really clear overview of Opay Savings and the different aspects to consider like interest rates and account types. I appreciate the FAQs section too—very helpful for anyone new to this. Looking forward to more insights!

Great overview of Opay Savings! I found the breakdown of interest rates really helpful, especially the comparison with other savings options. Looking forward to seeing how this evolves!

I found this blog post really informative! It clarified a lot of my questions about Opay Savings and the interest rates they offer. I’m particularly interested in how the savings features compare to traditional banks. Looking forward to more updates!

Great breakdown of Opay Savings! I found the comparison with traditional savings accounts really helpful. The interest rates seem competitive, and I appreciate the FAQs section clarifying common doubts. Looking forward to seeing how this evolves!

Great article! I found the section on interest rates particularly insightful. It’s interesting to see how Opay Savings compares to other options in the market. Looking forward to exploring more about their features!

Great breakdown of Opay Savings! I appreciated the clarity on interest rates and the FAQs section—it really helped me understand the benefits. Looking forward to trying it out!

Great insights on Opay Savings! The breakdown of interest rates and features really clarifies how it works. I’m particularly interested in how it compares to other savings options available. Looking forward to more updates!

Great insights on Opay Savings! I appreciate the clarity on interest rates and the FAQs section. It really helped me understand how to maximize my savings. Looking forward to more updates!

What¦s Going down i’m new to this, I stumbled upon this I have found It positively useful and it has helped me out loads. I am hoping to contribute & aid different users like its aided me. Great job.

Thank you for the good writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! However, how can we communicate?

I found the comparison of Opay Savings, Target, and Fixed accounts really insightful! It’s great to see a breakdown of interest rates and how they can impact savings. The FAQs section clarified a lot of my doubts too. Can’t wait to explore these options further!

Your article helped me a lot, is there any more related content? Thanks!

This was a really informative post! I love how you broke down the different savings options with Opay. The interest rates comparison is super helpful for making an informed decision. Looking forward to seeing more updates on Opay’s offerings!

This post was super informative! I had heard about Opay Savings but didn’t fully understand how it works. The breakdown of interest rates and the FAQs section was particularly helpful. It’s great to see such clarity on financial products. Thanks for sharing!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQs. It really helps to clarify how this savings platform works and its benefits. Looking forward to seeing how it evolves in the future!

I found this post really insightful! The breakdown of Opay Savings and its interest rates was particularly helpful. I’m curious to see how it compares to traditional savings options in the long run. Thanks for addressing the FAQs, it made things much clearer!

Great breakdown of Opay Savings! I appreciate the clarity on interest rates and the FAQs. It’s helpful to understand how it compares to other savings options. Looking forward to seeing how the platform evolves!

This post provides such a clear overview of Opay Savings! I appreciate the breakdown of interest rates and the FAQs section—super helpful for someone like me trying to understand all the details. I’m excited to explore the Owealth and Target features! Thank you for the insights!

Great breakdown of Opay Savings! I appreciate the clarity on the interest rates and how they compare with other savings options. The FAQs were particularly helpful in addressing common concerns. Looking forward to seeing how this evolves!

Hey! This is my first visit to your blog! We are a group of volunteers and starting a new initiative in a community in the same niche. Your blog provided us beneficial information to work on. You have done a outstanding job!

Great breakdown of Opay Savings! I appreciate the clarity on interest rates and the FAQs. It’s helpful to understand how it compares to traditional savings options. Looking forward to seeing how it develops over time!

Great overview of Opay Savings! The breakdown of interest rates and the comparison with other savings options really helped clarify things for me. I’m curious about the withdrawal limits—how do they compare to traditional savings accounts? Thanks for the insights!

Great insights! I appreciate the detailed breakdown of Opay Savings and the comparison of interest rates. It really helps in understanding how to make the most of my savings. Looking forward to trying it out!

Great insights on Opay Savings! I really appreciate the detailed breakdown of interest rates and the FAQs section. It’s always good to understand how different savings options work before diving in. Thanks for the informative post!

A person essentially assist to make critically articles I would state. This is the first time I frequented your website page and to this point? I surprised with the analysis you made to make this actual publish amazing. Fantastic activity!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQs—it really clarifies how it works. Looking forward to seeing how it compares with other savings options in the future. Thanks for sharing!

Great insights on Opay Savings! I’m particularly intrigued by the interest rates and how they compare to traditional savings accounts. The FAQs section was really helpful in clarifying some of my doubts. Looking forward to seeing how this platform evolves!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQs section—it really clarifies how it all works. Looking forward to trying it out!

hello!,I like your writing very so much! percentage we communicate extra approximately your article on AOL? I need an expert in this space to unravel my problem. Maybe that’s you! Taking a look ahead to look you.

The following time I learn a weblog, I hope that it doesnt disappoint me as a lot as this one. I imply, I know it was my choice to read, but I truly thought youd have one thing interesting to say. All I hear is a bunch of whining about something that you may fix if you werent too busy searching for attention.

Great insights on Opay Savings! It’s helpful to understand the interest rates and how they compare with traditional savings options. I’m particularly interested in the features of the Target and Fixed savings plans. Could you provide more examples of how users have benefited from these options? Thanks for the informative post!

Great breakdown of Opay Savings! It’s super helpful to see the comparison with other options like Owealth and Target. I’m particularly interested in the interest rates and how they stack up against traditional savings accounts. Thanks for clarifying the FAQs too! Looking forward to seeing how this evolves.

Nice post. I was checking continuously this blog and I am impressed! Very helpful information specially the last part 🙂 I care for such information much. I was seeking this certain information for a long time. Thank you and good luck.

Great insights! I really appreciate how you broke down the key features of Opay Savings and the interest rates. It’s helpful to know the FAQs too. Looking forward to trying it out!

Great insights! I appreciate the breakdown of Opay Savings and how it compares to traditional savings options. The interest rates you mentioned seem competitive, and I found the FAQ section really helpful for clarifying common concerns. Looking forward to seeing how this platform evolves!

Great overview of Opay Savings! I appreciate the detailed breakdown of interest rates and the FAQ section. It really helps clarify how it all works. I’m curious about the long-term benefits of using this service compared to traditional savings accounts. Looking forward to hearing more insights!

Great insights on Opay Savings! The breakdown of interest rates and features really helps clarify how it works. I had a few questions about withdrawal limits and how often I can make transfers—any chance those details could be included in future posts? Thanks!

I found the comparison of Opay Savings with Owealth and Target really insightful! The breakdown of interest rates made it easier to understand how each option stacks up. I still have a few questions about the withdrawal process; it would be great to see more details on that in a future post! Thanks for the informative content!

hello there and thanks for your info – I’ve definitely picked up anything new from right here. I did alternatively expertise some technical points the usage of this site, as I experienced to reload the web site many times prior to I may get it to load correctly. I had been thinking about if your web host is OK? Now not that I’m complaining, but sluggish loading circumstances occasions will sometimes affect your placement in google and could damage your high-quality rating if advertising and ***********|advertising|advertising|advertising and *********** with Adwords. Anyway I am including this RSS to my e-mail and can glance out for much more of your respective interesting content. Ensure that you update this again soon..

Great insights! I appreciate the breakdown of Opay Savings and the comparison of interest rates. It’s helpful to know how it stacks up against traditional banks. Looking forward to more updates on this topic!

This post really clarifies what Opay Savings is all about! I appreciate the breakdown of interest rates and the FAQs section—it makes it so much easier to understand the benefits. It’s great to see more options for saving with competitive rates. Thanks for sharing!

This blog post really clarified the different savings options available with Opay! I’m particularly interested in the interest rates mentioned and how they compare to traditional banks. The FAQs section was super helpful too—answered a lot of my queries. Thanks for breaking it all down so well!

Great insights! I’m particularly intrigued by the interest rates offered by Opay Savings compared to traditional banks. It’s nice to see more options for saving in today’s digital age. Looking forward to trying it out!

This post provides a clear and comprehensive overview of Opay Savings! I’m particularly interested in the interest rates you mentioned. Do you have any tips on how to maximize earnings with this savings option? Thanks for the great information!

This blog post on Opay Savings was incredibly helpful! I had a lot of questions about the interest rates and how the target saving feature works. The FAQs section answered all my queries perfectly. Thanks for breaking it down so clearly!

Great insights in this post! I appreciate the detailed breakdown of Opay Savings and how it compares to other options. The interest rates you mentioned seem quite competitive. I’m curious about the FAQs section – are there specific common concerns about Opay Savings that you think potential users should be aware of? Thanks for sharing!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQs section; it really clarifies what to expect. Looking forward to trying it out and seeing how it compares to other savings options. Thanks for the informative post!

Launch into the stunning realm of EVE Online. Forge your empire today. Trade alongside millions of pilots worldwide. [url=https://www.eveonline.com/signup?invc=46758c20-63e3-4816-aa0e-f91cff26ade4]Start playing for free[/url]

I found this post on Opay Savings really informative! The breakdown of the interest rates and how they compare to traditional savings is super helpful. I have a few questions about the withdrawal process though—could you clarify if there are any penalties for early withdrawals? Thanks!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQs—super helpful for anyone considering this option. I’m curious about how often interest is compounded. Thanks for sharing!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQs. It’s really helpful for someone like me who is exploring new saving options. Looking forward to seeing how it compares to other platforms!

This post is incredibly informative! I love how you broke down the details of Opay Savings and the different interest rates offered. It’s great to have a clear comparison of options like Owealth and Target. The FAQs section was especially helpful in addressing common concerns. Thanks for shedding light on this topic!

I found the breakdown of Opay Savings really helpful! The comparison of interest rates between different offerings made it clearer for me to decide where to save. I’m particularly interested in how the withdrawal limits impact daily use. Could you elaborate on the benefits of targeting specific savings goals with Opay? Thanks for the informative post!

This blog post provides a great overview of Opay Savings! I appreciate the clarity on interest rates and the FAQs section—it really helped answer some of my questions. I’m curious to know more about how the target savings feature works and what strategies others have used to maximize their savings. Looking forward to learning more!

I found this post on Opay Savings really informative! The breakdown of interest rates and the comparisons with other savings options were particularly helpful. I’m curious to see how the platform performs over time and whether the interest rates will remain competitive. Thanks for sharing such detailed FAQs!

This post on Opay Savings was super informative! I appreciate the breakdown of interest rates and options available. It’s great to know more about savings tools in Nigeria. Looking forward to trying it out!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the detailed FAQs. It really helps in understanding the benefits and features. Looking forward to trying it out!

Great post! I found the breakdown of Opay Savings really helpful, especially the part about interest rates. It’s interesting to see how it compares to traditional savings accounts. Looking forward to more updates on this!

Great breakdown of Opay Savings! I was curious about how their interest rates compare to traditional banks, and the FAQs section really cleared up my questions. Looking forward to exploring the potential benefits of using Opay for savings!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQs. It’s refreshing to see a clear comparison of options like Owealth and Target. Looking forward to trying it out!

Great post! I found the breakdown of Opay Savings and the interest rates really helpful. It’s interesting to see how it compares to other savings options out there. I have a few questions about the withdrawal process—do you have any insights on that?

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQ section really helped clarify some of my concerns. I’m curious about how Opay compares to other savings options in terms of flexibility and customer service. Looking forward to more updates!

This post really clarifies what Opay Savings is all about! The breakdown of interest rates and the FAQs section was especially helpful. I’m excited to see how this could help with my savings goals. Thanks for the detailed insights!

Great overview of Opay Savings! I appreciate the detailed breakdown of interest rates and the comparison with other savings options. It’s exciting to see financial technology making savings more accessible. Looking forward to more updates and tips on maximizing savings.

This post provided such valuable insights into Opay Savings! I didn’t realize how competitive their interest rates are compared to traditional banks. The FAQs section was particularly helpful in clarifying some of my concerns. Thanks for breaking this down so clearly!

I found this post really informative! The breakdown of Opay Savings and its interest rates is clear and helpful. I appreciate the FAQs section as it addresses common concerns. Looking forward to exploring more about how to maximize savings with Opay!

This post really clarified a lot about Opay Savings for me! I’m particularly interested in the interest rates and how they compare with traditional banks. The FAQs section was super helpful in answering my initial questions. Looking forward to seeing how my savings can grow with Opay!

Great insights on Opay Savings! The breakdown of interest rates and the comparison with traditional savings options was particularly helpful. I’m curious about the safety of funds and how quickly withdrawals can be processed. Thanks for the informative post!

Great breakdown of Opay Savings! I love how you clarified the differences between Owealth, Target, and Fixed plans. The FAQs section was particularly helpful in understanding the interest rates and terms. Looking forward to seeing more content on savings strategies!

Great insights on Opay Savings! I’m particularly interested in the interest rates and how they compare to traditional savings accounts. Looking forward to more updates on this topic!

Great insights in this post! I love how you broke down the details of Opay Savings and the various interest rates. It makes it much easier to understand what options are available. Looking forward to more updates and tips on smart saving!

Great insights on Opay Savings! I appreciate the detailed breakdown of interest rates and the FAQs. It’s refreshing to see clear information that can help users make informed decisions. Looking forward to more posts like this!

I found this post on Opay Savings incredibly informative! The breakdown of interest rates and the FAQ section answered so many of my questions about how the platform works. I’m definitely considering giving it a try for my savings. Thanks for sharing!

This post provides a great overview of Opay Savings! I appreciate the breakdown of interest rates and the FAQs section—it really clarifies a lot. I’m curious, though, are there any minimum deposit requirements to start saving with Opay?

This blog post on Opay Savings is incredibly insightful! The breakdown of interest rates and the comparison with traditional savings options really helps clarify the benefits. I appreciated the FAQs section as well; it answered a lot of my initial questions. Looking forward to seeing how this impacts my savings strategy!

This blog post provides an excellent breakdown of Opay Savings and its offerings. I appreciate the clarity on the interest rates and how they compare to other options. The FAQs were particularly helpful in addressing common concerns. Looking forward to trying out the service!

Great insights on Opay Savings! I appreciate how you broke down the interest rates and features. It definitely clarifies how it compares with other options in the market. Looking forward to seeing how this evolves!

I found this post on Opay Savings really informative! The breakdown of interest rates and FAQs made it easy to understand. I appreciate how you highlighted the benefits and potential downsides. Looking forward to more updates on this topic!

Great post! I appreciate the detailed breakdown of Opay Savings and how the interest rates compare to traditional savings accounts. The FAQs section really helped clarify some of my doubts. Looking forward to seeing how this evolves!

I found this post on Opay Savings really insightful! It’s great to see a clear breakdown of interest rates and the different savings options available. The FAQ section was particularly helpful in addressing some of my concerns. Looking forward to trying out the Owealth feature!

Great post! I really appreciate how you broke down the features of Opay Savings and explained the interest rates in detail. It’s helpful to know all the options available, especially for someone looking to maximize their savings. Looking forward to more insights!

I really appreciated this breakdown of Opay Savings! The interest rates seem competitive, and it’s helpful to see a clear comparison with what other platforms offer. The FAQs section answered a lot of my initial questions, but I’m curious about any hidden fees and the ease of access to funds. Looking forward to more insights!

This blog post provided a really insightful overview of Opay Savings! I particularly found the breakdown of interest rates and the comparisons with other savings options helpful. The FAQs section addresses so many common concerns—I appreciate the clarity it brings. Can’t wait to see how Opay evolves in the coming months!

This post was super informative! I’ve been curious about Opay Savings and how it compares to other savings options. The breakdown of interest rates and FAQs really helped clarify things. I’m looking forward to giving it a try! Thanks for the detailed insights!

Great insights on Opay Savings! I appreciate the detailed breakdown of interest rates and the comparisons with traditional savings options. It really helps in making informed decisions. Looking forward to more updates!

This post does a great job explaining the different savings options with Opay! I’m particularly interested in the interest rates and how they compare to traditional banks. Does anyone have personal experiences with Opay Savings? Would love to hear more about the platform!

I found the breakdown of Opay Savings really insightful! The comparison of interest rates and the FAQs section clarified a lot of my doubts. It’s great to see how easy it is to manage savings with their platform. Looking forward to trying it out!

I found the analysis of Opay Savings really helpful! The comparison of interest rates with other savings options was particularly insightful. I appreciate how you addressed the common FAQs, making it easier to understand the benefits and potential drawbacks. Looking forward to more posts like this!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQs section. It really helped clarify how the savings feature works. Looking forward to seeing how it evolves!

This post really clarified how Opay Savings works and the different interest rates available. I love the comparison with other platforms like Target and Fixed. The FAQs section is super helpful too! Can’t wait to start saving with Opay!

Great insights on Opay Savings! I’m particularly interested in how the interest rates compare to traditional banks. Looking forward to trying it out!

Thank you for breaking down Opay Savings in such detail! The comparison of the Owealth and Target savings options really helped clarify their differences for me. I appreciate the insights on interest rates and the FAQs—super helpful for making an informed decision. Looking forward to more posts like this!

Great insights on Opay Savings! The breakdown of interest rates and the features of the Owealth and Target accounts really helps clarify their differences. I’m particularly interested in the flexible savings options they’ve introduced. Looking forward to more updates!

I really appreciated this clear breakdown of Opay Savings! The comparisons of interest rates and the FAQs section were especially helpful in understanding the benefits. I’m excited to see how this platform evolves—thanks for sharing such insightful information!

I found this post incredibly informative! The breakdown of Opay Savings and the interest rates really helped clarify how it works. I appreciate the FAQs section too; it answered a lot of my questions. Looking forward to seeing how these options evolve!

Great insights on Opay Savings! I found the breakdown of interest rates really helpful, especially for someone considering different savings options. The FAQs section answered a lot of my questions. Looking forward to more posts like this!

Great post! I’m really intrigued by the different savings options Opay offers. The interest rates seem competitive, and I appreciate the FAQs section that clarifies a lot of my concerns. Looking forward to exploring more about how Opay Savings can help me manage my finances better!

Great insights on Opay Savings! I appreciate the breakdown of interest rates and the FAQs. It’s helpful to understand how it compares to other savings options. Looking forward to more updates and tips on maximizing savings!

I found this post on Opay Savings really informative! The breakdown of interest rates and features like Target and Fixed savings options is super helpful. I’m definitely considering giving it a try now, especially with those FAQs clearing up my concerns. Thanks for the insights!

This blog post did a great job of breaking down the different savings options with Opay! I had no idea about the varying interest rates. The FAQs section was particularly helpful in clarifying some of my doubts. Thanks for the informative read!

Great post! I’ve been curious about Opay Savings and how it compares to other savings options. The interest rates seem attractive, and the breakdown of FAQs really helped clarify some of my doubts. Looking forward to reading more about personal finance tips!